Top 10 DeFi projects to watch in 2021

Hubert Dolata

16 December 2020

We asked hundreds of experts the same question: What are the DeFi projects that you will be watching in 2021?, then combined the most recurrent answers together and created this article. We have used the Wisdom of Crowds method to get a list of the top 10 DeFi projects that experts in the industry will be watching in 2021. This method is more reliable than asking a single famous crypto influencer and relying on one (or a few) answers.

Do you want support DeFi? Join DeFi Wisdom Pools and help us to spread the idea

If you have been following blockchain, you have probably already heard of the recent emerging industry called DeFi, which has experienced substantial growth, and is now worth over $14 billion. Everyone is talking about Decentralized Finance, and even the crypto giants such as CoinMarketCap and CoinGecko have introduced separate lists dedicated to DeFi projects.

But why?

Before we go any further, let’s explain what exactly DeFi is, and why it’s so important.

DeFi follows the idea of rebuilding the infrastructure of financial services and moving it into a fully decentralized structure, removing the need for third parties such as companies and governments. We need DeFi because it has the unique opportunity to revolutionize the global financial landscape.

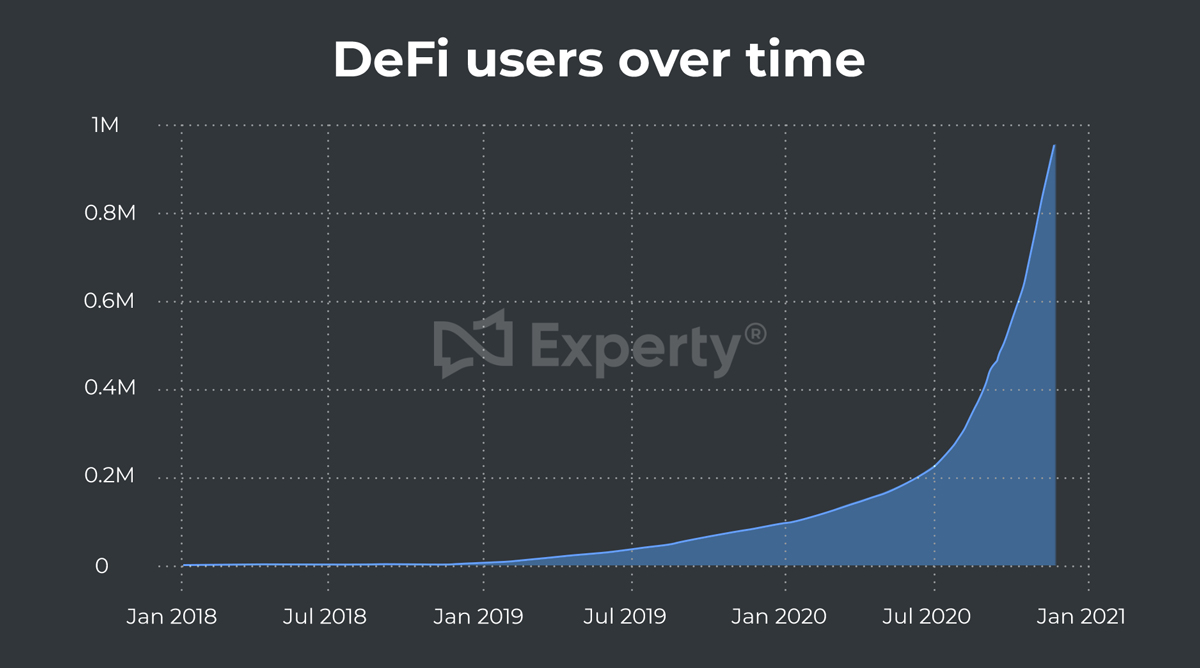

According to crypto market data aggregator Dune Analytics, we can see that cumulatively, the total number of unique DeFi user addresses has grown to 926,600, an increase of roughly 11 times over the past year.

Data source: duneanalytics.com

From July until November, the DeFi ecosystem went from $4 to over $14 billion (source) which is a massive move and has caused many investors to start thinking whether or not it’s too late to invest in Decentralized Finance. Luckily for you, there are still many undervalued projects, and in this article, we will discuss some of them.

At Experty.io you can access the same crypto experts who helped us in the creation of this article. Their opinions and explanations were used to provide the highest quality of project selections.

We asked hundreds of experts in the Blockchain sphere about the best DeFi projects to watch in 2021, and then we took the 10 tokens that were mentioned the most, and combined everything in one article.

1. Uniswap

Uniswap is a protocol for exchanging ERC-20 tokens on Ethereum. It provides a user-friendly and low latency interface for direct ETH and ERC20 token swapping. Because of its DEX nature, Uniswap doesn't take any fees for themselves. It's designed to function as a public good.

Many users prefer to use Uniswap because, unlike most exchanges, Uniswap doesn't have an order book. It uses a mechanism called "Constant Product Market Maker" which determines the exchange rate and price slippage. Uniswap has three main users: Casual Users, Liquidity Providers, and Arbitrageur, each of them playing an important role in the ecosystem. Liquidity Providers are incentivized to provide capital to earn transaction fees generated by Casual Users, and Arbitrageurs are incentivized to provide external price information by earning spreads between Uniswap and other markets.

2. Yearn Finance

Yearn.finance is a decentralized finance (DeFi) platform which aims to perform a host of functions such as aggregated liquidity and automated market-making by moving providers' funds between platforms such as dYdX, Aave, and Compound.

Yearn gives access to advanced earning mechanisms and gives people easy access to new investment strategies. By holding $YFI in its protocol you will earn a % share of the fees generated by other users.

3. Chainlink

Chainlink is a decentralized oracle. An oracle is a data feed that connects blockchains to off-blockchain data. The Chainlink network provides reliable tamper-proof inputs and outputs for complex smart contracts on any blockchain. Chainlink can get information in and out of a blockchain in a way that's secure, trustworthy, and decentralized.

What makes Chainlink stand out from the crowd is their token usage ecosystem. The LINK token is used by smart contract owners to pay chainlink nodes to get data from them. The more LINKs a node has, the more reputable it is. So oracle providers are incentivized to hold as many LINKs in their chainlink nodes to gain more usage and profit.

4. Compound

Compound is a software running on Ethereum that allows borrowers to take out loans, lenders to provide loans by locking their crypto assets into the protocol. The interest rates paid and received by borrowers and lenders respectively are determined by the supply and demand of each crypto asset.

Compound allows you to receive profit at a faster rate than simple interest on the money you already have. This is achieved through its unique lending system. The longer you hold a balance with them, the greater the potential interest you're able to earn.

5. Kava

Kava is a next-generation decentralized lending platform that seeks to bring new flexibility to the market. The network is known for its cross-chain cryptocurrency swapping ability, allowing users to swap cryptocurrencies that exist on different blockchains.

Kava's swapping application called Switch is nearly instantaneous, even across blockchains. Kava also allows for lending, and they seek to streamline the decentralized lending sector. This has led Kava to be a pioneer in the DeFi sector.

6. DAI

DAI is a stablecoin that is created when a loan is taken out on MakerDOA with collateral. It's pegged to the US Dollar and offers stability and transparency through decentralization. That makes it reliable when money is lent and borrowed because the value stays the same.

DAI now supports the ability to use multiple cryptocurrencies as collateral instead of just ETH. Users can place down their cryptocurrency as collateral for a DAI loan, and take it back for the same price even if it has increased in value over time. DAI's decentralization makes it difficult to manipulate by a person or company, unlike other centralized stablecoins.

7. Ankr

Ankr's distributed computing platform enhances the sharing economy by harnessing idle computing power and making it available to businesses and consumers. Enterprises will be able to monetize surplus computing power through Ankr and allow users to tap into otherwise unattainable cost-effective cloud computing. This relationship benefits both parties and is a secure approach to distributed cloud computing.

8. Metronome

Metronome aims to create a protocol that can transfer value not just inside of a single blockchain, but also across different blockchains. Enhancing the decentralized nature of cryptocurrencies, the governance and community of Metronome will be open-source and autonomous.

Metronome supports advanced payment features, such as Mass Pay, an option that allows users to transfer the token MET to multiple addresses in a single transaction. This saves money on fees. Blockchains come and go, but Metronome has set its sights on longevity through deepening decentralization, bringing the benefits of multiple blockchains together, and building on the transaction abilities that users already enjoy with cryptocurrencies.

9. Aleph.im

Aleph.im is a cross-chain network built over blockchains (layer-2) with a focus on decentralized applications (dApps). Aleph.im aims to allow serverless computing, file storage, and databases in combination with trustless data management and GDPR compliance.

Aleph.im seeks to revolutionize cloud computing by being the first cloud-native blockchain. They've already released a decentralized storage dApp, and their website is hosted on the network as well.

10. Orion Protocol

Orion Protocol solves some of the largest issues in DeFi by unifying the liquidity of the entire crypto market (CEXs, DEXs, swapping pools) into one decentralized platform. They're open-sourced and aim to lower the risk of holding cryptocurrencies on centralized and decentralized exchanges.

Orion Protocol is the first project to implement a Dynamic Coin Offering (DYCO), a new token sale framework in which utility tokens are USD-backed for up to 16 months after the TGE, and participants are entitled to an 80% refund. This level of protection and safety gives a huge advantage to users, offering a new level of trust and reliability.

11. Experty

Experty created a new tool that democratizes the consultation and information exchange market, so if you’re interested in Decentralized Finance, then for sure you must join our DeFi Wisdom Pool Our mission is to remove the barriers around specialized knowledge and give users quick and easy access to specialists in the blockchain space.

Create your own pool of knowledgeable experts and pay as low as $0.99 for each reply within 24 hours - or get a 100% refund with zero risks.

Also, If you have any kind of interest in Decentralized Finance you shall join as an expert and start receiving profitable relevant messages about crypto, blockchain, DeFi - from founders, executives, and researchers.

We want to improve the flow of reliable online information on fair terms for everyone.

Conclusion

It's probable that we are still very early on when it comes to the rate of DeFi adoption, and these 10 featured projects may gradually grab the spotlight they deserve. Freedom from the monetary control of centralized institutions is the ultimate vision of this movement.

The growth of decentralized finance (DeFi) has been the big cryptocurrency story of 2020, and with good reason. We're probably looking at the future of the Financial Services industry; however, there is still a long way to go.

At Experty our mission is to build a community full of contributors, experts, and users that will help us democratize worldwide DeFi knowledge and information exchange.

Will you take the journey with us?

Feel free to send us any comments, questions, reports, or bright ideas. Let's talk on Facebook Community Group

P.S.

We have received hundreds of answers from the best experts in the crypto industry. These are some of the projects that garnered a lot of attention, but didn't make it to the top 10 list.

Aave is a DeFi lending protocol that enables users to lend and borrow a diverse range of cryptocurrencies using both stable and variable interest rates.

Anyswap is a fully decentralized cross-chain swap protocol, based on Fusion DCRM technology, with an automated pricing and liquidity system. Anyswap enables swaps between any coins on any blockchain that use ECDSA or EdDSA as a signature algorithm, including BTC and ETH.

Bancor Protocol is a standard for decentralized exchange networks used to allow for the automated conversion of cryptocurrency tokens into other tokens, including across blockchains, without the need for an order book or counterparty to facilitate the exchange.

HEX is designed to be a store of value to replace the Certificate of Deposit as the blockchain counterpart of that financial product used in traditional financial markets. HEX is also designed to leverage off the emerging DeFi (Decentralised Finance) ecosystem in cryptocurrencies within the Ethereum network.

Gnosis is the primary use case of GNO, which is for generating OWL tokens via staking. Users can lock GNO for a certain amount of time (up to one year) to earn rewards. (The amount of OWL received is calculated based on the length of the staking period.)

Experts in the crypto industry are giving these projects special attention, so they're worth checking out even if they're not on our top ten list. As always, we recommend that you do your own research and read up more on these projects before taking action.

Please Do Your Own Research always! We are not financial advisors, any information provided in this article is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we present is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Si desea leer este artículo en español, haga clic aquí

Aby przeczytać ten artykuł w języku polskim, kliknij tutaj