Uniswap - May 2024 Price Update - 76% Breakout News and Analysis

On May 20, 2024, Uniswap (UNI) experienced a significant breakout, with its price surging by approximately 76%, reaching a new high of $8.90. This remarkable gain can be attributed to several strategic and technological advancements within the Uniswap ecosystem. Let's delve into the key reasons behind this price surge and explore the implications for the market.

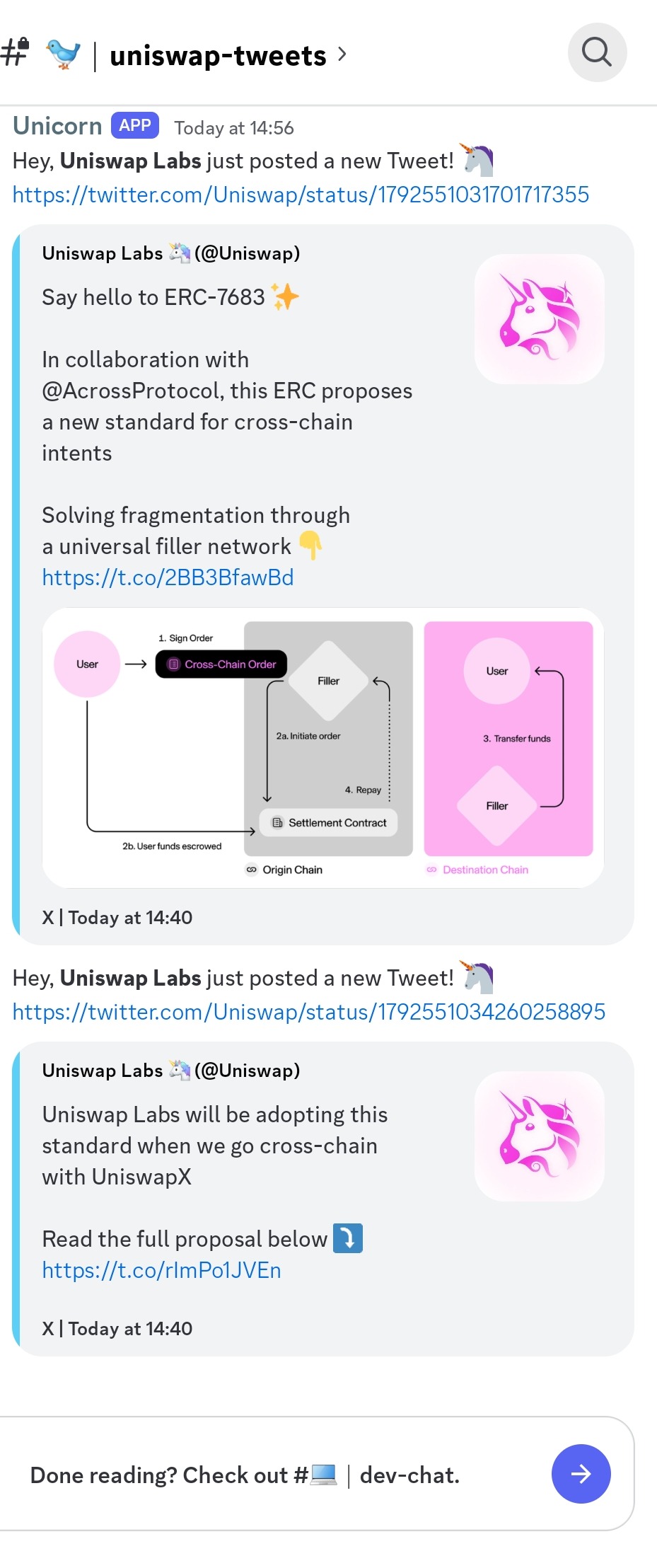

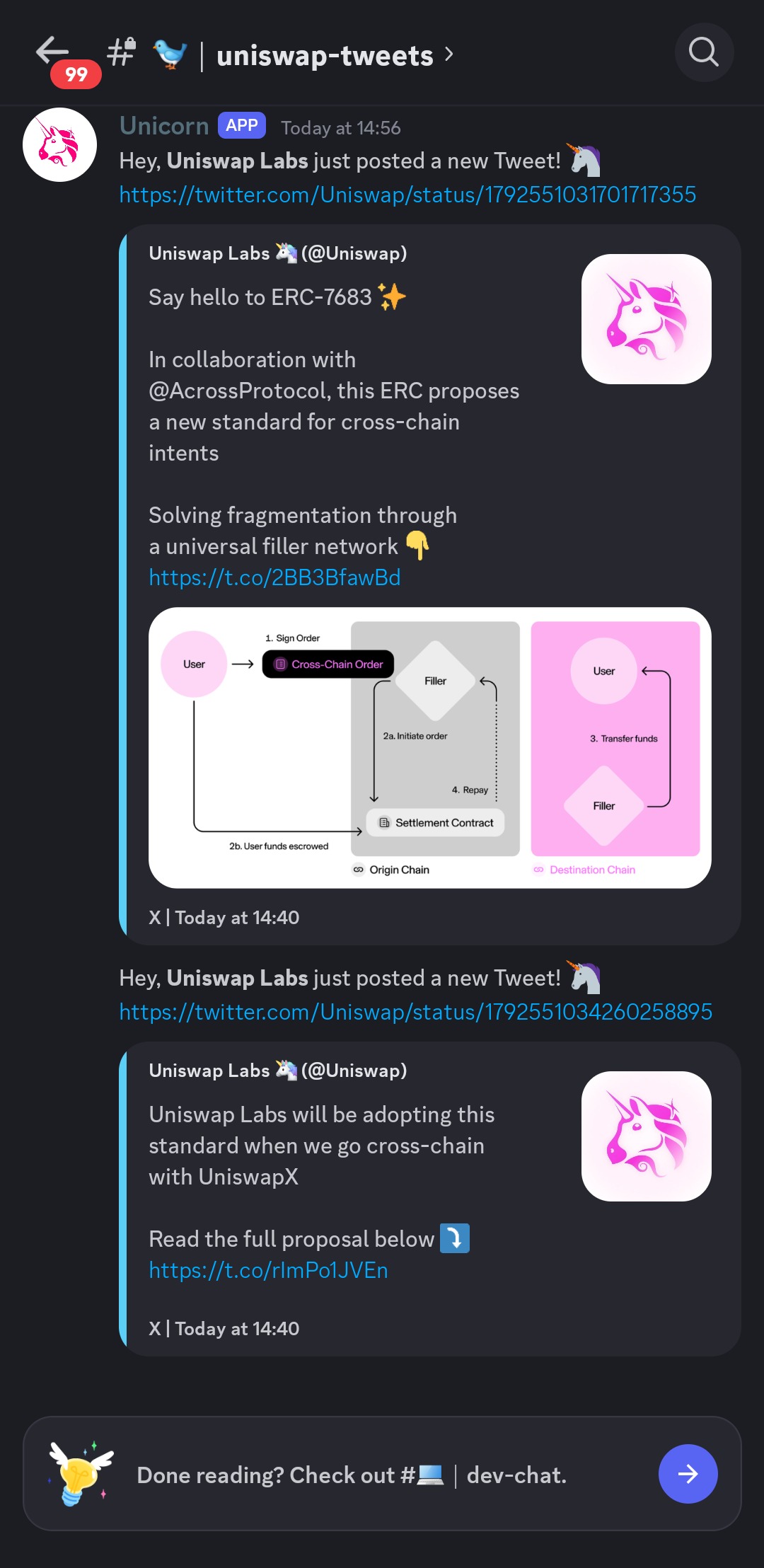

UniswapX integration with ERC7683: Uniswap announced its integration with the new ERC7683 token standard for crosschain swaps on the forthcoming platform UniswapX, enhancing interoperability.

ERC7683 enhances liquidity and filler networks: ERC7683 aims to improve crosschain intents by creating a universal filler network, thus enhancing liquidity and filler networks, and reducing costs.

ERC7683 targets crosschain trading issues: The ERC7683 standard aims to streamline crosschain trading solutions by proposing a standard set of rules and interfaces for blockchain networks.

ERC7683 for crosschain intents: ERC7683 proposes a new standard for crosschain intents, solving fragmentation and improving user experience by increasing competition for fulfilling user intents.

Overview

Uniswap is a leading decentralized trading protocol known for its role in facilitating automated trading of decentralized finance (DeFi) tokens. Launched in November 2018, Uniswap has gained significant traction due to the DeFi boom and its innovative approach to solving liquidity issues in decentralized exchanges. The protocol aims to keep token trading automated and open to anyone holding tokens, enhancing trading efficiency compared to traditional exchanges.

Key Features

Automated Market Maker (AMM)

Eliminates Traditional Order Books: Users trade directly with liquidity pools, reducing reliance on thirdparty intermediaries. Decentralization: Operates on the Ethereum blockchain, promoting a permissionless and censorshipresistant environment. Accessibility: Anyone with an internet connection and a compatible cryptocurrency wallet can access and trade on Uniswap.

Use Cases

Token Swapping: Users can easily swap between various cryptocurrencies. Liquidity Providing: Users can contribute their crypto holdings to liquidity pools and earn fees from trading activity. New Token Listings: Projects can launch their tokens on Uniswap, facilitating easier access to liquidity and wider adoption.

Recent Developments

Key Updates

ERC7683 Standard: In collaboration with Across Protocol, Uniswap introduced ERC7683, a new industry standard for crosschain intents, aiming to solve fragmentation through a universal filler network. New Features: Introduction of Uniswap Extension, Limit Orders, and updated Pool and Token Detail Pages. Multichain Support: Now supports multiple Layer 1 networks like Ethereum, Polygon, and Layer 2 networks like Base, Arbitrum, and Optimism.

Community Engagement

Active Community: Regular AMAs, contests, and participation in major conferences and DeFi events. Governance: UNI token holders can participate in discussions and vote on proposals that shape the future of the protocol.

Market Impact

User Growth and Trading Volume

May 2023 Spike: Achieved an alltime high of over 523,000 monthly interface traders. Dominant Ethereum DEX Volume: Consistently maintains a dominant position in daily trading volume on the Ethereum blockchain.

Potential for Future Growth

Increased Liquidity: Facilitates significant liquidity for various cryptocurrencies, promoting a more efficient and accessible market. Innovation in DeFi: The AMM model pioneered by Uniswap has inspired the development of numerous other DEXs.

Risks and Opportunities

Challenges

Security Concerns: As with any DeFi protocol, security breaches and technical issues are potential risks. Market Competition: Increasing competition from other DEXs and DeFi platforms.

Opportunities

CrossChain Interoperability: ERC7683 standard could position Uniswap as a leader in crosschain transactions. User Adoption: Continued innovation and feature updates could drive higher user adoption and market share.

Community Engagement

Size and Activity

Active Discussions: High levels of activity on platforms like Reddit, Twitter, and Discord. Engagement Strategies: Regular updates, AMAs, and community contests to keep users engaged.

Conclusion

Uniswap stands out in the crowded DeFi space due to its innovative AMM model, strong community engagement, and continuous feature updates. The introduction of ERC7683 and multichain support positions it well for future growth. Traders should consider Uniswap's robust market presence, active community, and potential for innovation when evaluating investment opportunities. The project's decentralized nature and commitment to improving trading efficiency make it a compelling choice for those looking to invest in the DeFi sector.

Summary

In summary, Uniswap's recent breakout can be attributed to the strategic integration of the ERC7683 token standard and the launch of UniswapX, which collectively enhance crosschain interoperability, liquidity, and user experience. These developments underscore the importance of continuous innovation in the cryptocurrency market. As always, it's crucial for investors to conduct thorough research (DYOR) to navigate the complexities of the cryptocurrency market effectively.

Please Do Your Own Research always! We are not financial advisors, any information provided in this article is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we present is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.