News of Tribe (TRIBE) - July 2024 Price Update - 8% Breakout Crypto News and Analysis

On July 30, 2024, at 11:04 AM UTC, Tribe (TRIBE) experienced a significant breakout, with its price surging by 8.14% to $0.55. This unexpected rise in value has caught the attention of the cryptocurrency community, sparking discussions about the underlying factors driving this movement. Tribe, the governance token for the FEI algorithmic stablecoin, has been relatively quiet in terms of project updates, making this breakout particularly intriguing. Let's delve into the reasons behind this price surge and what it means for the future of Tribe. On July 30, 2024, the Tribe (TRIBE) token experienced a notable breakout, with its price surging by 8.14% to reach $0.553. This unexpected rise in value can be attributed to several key factors, each providing unique insights into the dynamics behind the surge. Let's delve into the primary reasons driving this breakout and explore the corresponding visual evidence for a comprehensive understanding of the situation.

Strong Governance and Robust FEI Reserves

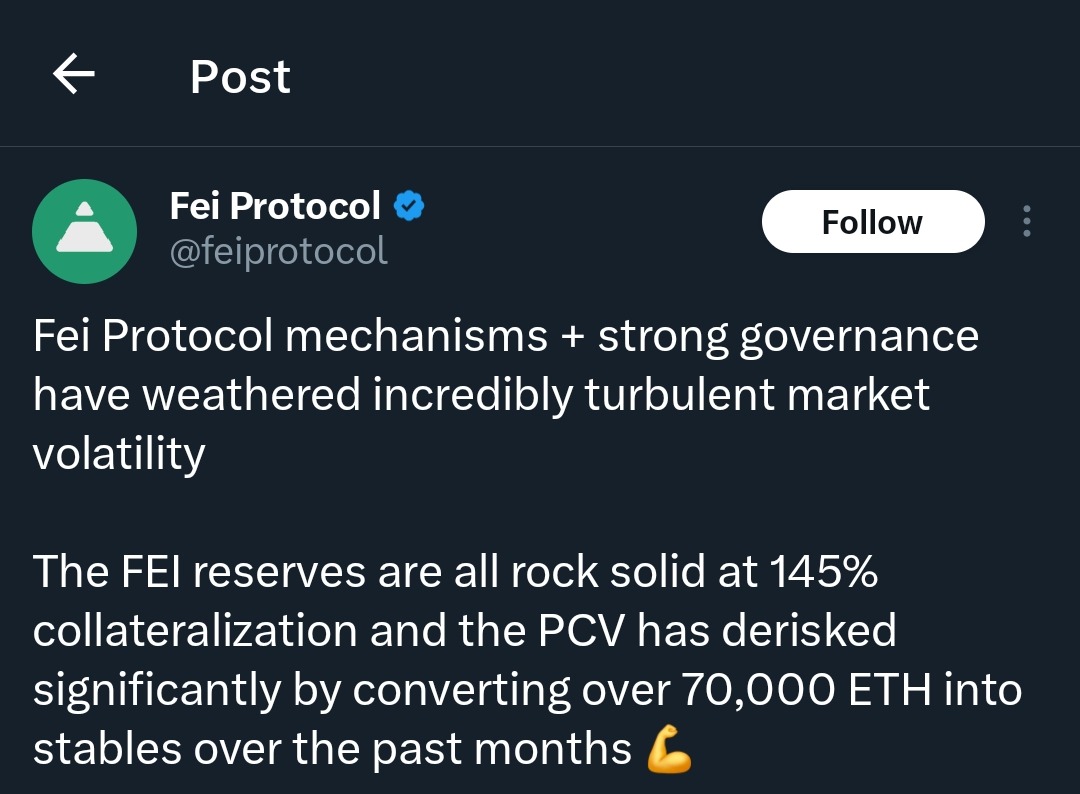

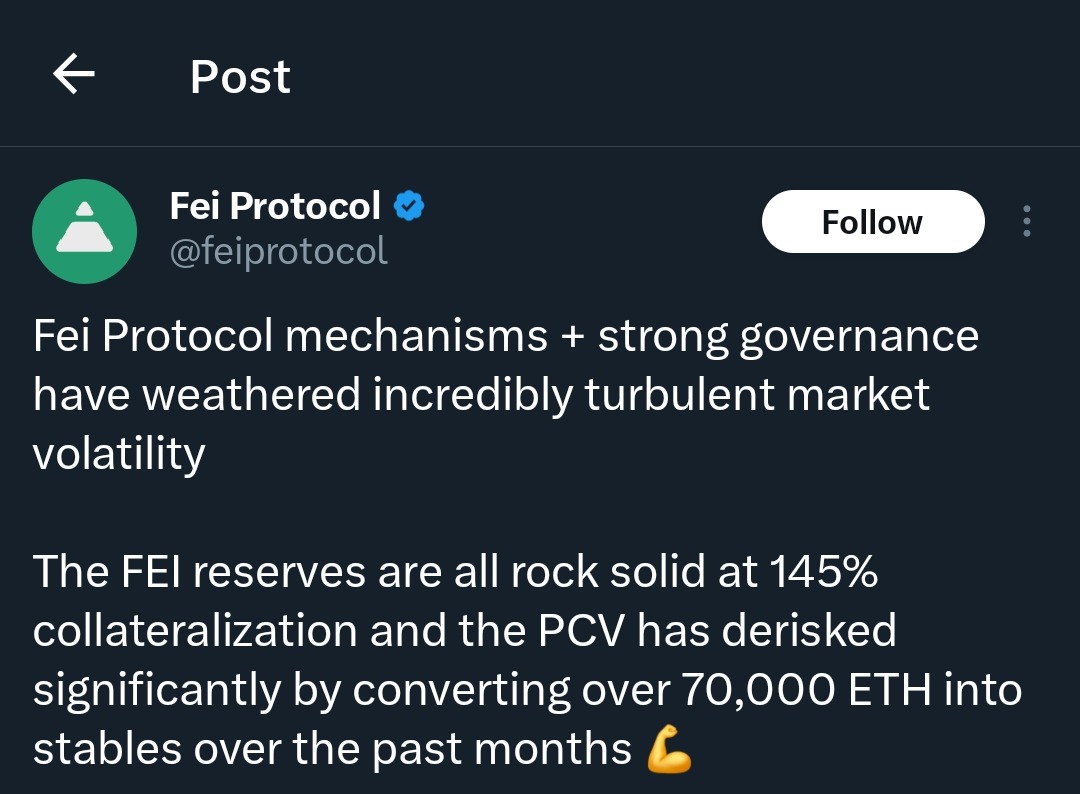

One of the most significant reasons behind TRIBE's price surge is the strong governance and robust FEI reserves. The FEI reserves are solid at 145% collateralization, which provides a strong foundation for the token's stability. Additionally, the Protocol Controlled Value (PCV) has derisked significantly by converting over 70,000 ETH into stablecoins over the past months. This strategic move has fortified the financial health of the protocol, instilling confidence among investors.

Strong governance and robust FEI reserves:

Community Activity Driving Price Change

Despite the inactivity from the team, the community holders appear to be driving the price change. This suggests that the community's engagement and activities are playing a crucial role in influencing the token's market performance. However, this also indicates an uncertain future as the sustainability of such communitydriven momentum remains to be seen.

Community activity driving price change:

Technological Advancements and Market Position

Another contributing factor to the breakout is the ongoing technological advancements and the enhanced market position of the Tribe token. The Fei Protocol mechanisms, coupled with strong governance, have weathered incredibly turbulent market volatility. This resilience has likely attracted more investors, boosting the token's market value.

Technological advancements and market position:

In conclusion, the recent breakout of the Tribe (TRIBE) token can be attributed to a combination of strong governance, robust FEI reserves, active community engagement, and ongoing technological advancements. Each of these factors has played a significant role in driving the token's price surge, and the visual evidence provided offers a clearer picture of their impact. As the market continues to evolve, it will be interesting to observe how these elements influence the future trajectory of TRIBE. In summary, the recent 8.14% breakout of Tribe (TRIBE) on July 30, 2024, can be attributed to strong governance and robust FEI reserves, along with active community participation. Despite the project's current quiet phase, the underlying fundamentals and community engagement have driven this price surge. As always, conducting thorough research (DYOR) is crucial for navigating the complexities of the cryptocurrency market effectively. Stay tuned for more updates and developments in the Tribe ecosystem.

We have asked 9 Experty community members questions related to "News of Tribe (TRIBE) - July 2024 Price Update - 8% Breakout Crypto News and Analysis". We have received many valuable replies, the best ones (based on Experty community feedback) you can read below.

Interested in a specific topic?

Pick one keyword and dive into this theme

Explore the Core.

Tribe is the governance token for the FEI algorithmic stablecoin. Fei aims to provide a new decentralized solution to the stablecoin market. Existing stablecoins are either fiat-collateralized and, therefore, centralized or crypto-collateralized, making them capital-inefficient. Other algorithmic stablecoins suffer from no liquidity backing the peg, making them inherently unstable or centralize rewards to seigniorage stakeholders. FEI proposes a model similar in design to fractional reserve central banking, where the protocol issues FEI for a subsidized price against ETH at its genesis event and subsequently uses the incurred Ether as a treasury to maintain the peg. TRIBE is the governance token of the DAO controlling the governance of FEI and can be used in governance proposals or swapped for FEI in a UniSwapV2 liquidity pool.

Spot the Main Event:

Fei Protocol mechanisms + strong governance have weathered incredibly turbulent market volatility The FEI reserves are all rock solid at 145% collateralization and the PCV has derisked significantly by converting over 70,000 ETH into stables over the past months

📸 Show Us What You Found:

To God be the Glory

Explore the Core.

Tribe is the governance token for the FEI algorithmic stablecoin. Fei aims to provide a new decentralized solution to the stablecoin market. Existing stablecoins are either fiat-collateralized and, therefore, centralized or crypto-collateralized, making them capital-inefficient. Other algorithmic stablecoins suffer from no liquidity backing the peg, making them inherently unstable or centralize rewards to seigniorage stakeholders. FEI proposes a model similar in design to fractional reserve central banking, where the protocol issues FEI for a subsidized price against ETH at its genesis event and subsequently uses the incurred Ether as a treasury to maintain the peg. TRIBE is the governance token of the DAO controlling the governance of FEI and can be used in governance proposals or swapped for FEI in a UniSwapV2 liquidity pool.

Spot the Main Event:

Fei Protocol mechanisms + strong governance have weathered incredibly turbulent market volatility The FEI reserves are all rock solid at 145% collateralization and the PCV has derisked significantly by converting over 70,000 ETH into stables over the past months

📸 Show Us What You Found:

Owojori

Explore the Core.

Tribe is the governance token for the FEI algorithmic stablecoin. Fei aims to provide a new decentralized solution to the stablecoin market. Existing stablecoins are either fiat-collateralized and, therefore, centralized or crypto-collateralized, making them capital-inefficient. Other algorithmic stablecoins suffer from no liquidity backing the peg, making them inherently unstable or centralize rewards to seigniorage stakeholders. FEI proposes a model similar in design to fractional reserve central banking, where the protocol issues FEI for a subsidized price against ETH at its genesis event and subsequently uses the incurred Ether as a treasury to maintain the peg. TRIBE is the governance token of the DAO controlling the governance of FEI and can be used in governance proposals or swapped for FEI in a UniSwapV2 liquidity pool.

Spot the Main Event:

There is a news at their website that the project has issues and the members should claim their token at a particular site. From their discord community, they posted an announcement that shows another project's airdrop.

📸 Show Us What You Found:

Overview

Tribe is the governance token for the FEI algorithmic stablecoin, aiming to provide a decentralized solution to the stablecoin market. Unlike traditional stablecoins that are either fiatcollateralized (centralized) or cryptocollateralized (capitalinefficient), FEI uses a model similar to fractional reserve central banking. This approach aims to maintain stability and decentralization, setting it apart in the crowded cryptocurrency market.

Key Features

Algorithmic Stablecoin: FEI maintains its peg through a fractional reserve model, using Ether (ETH) as a treasury. Governance Token: TRIBE is used for governance proposals and can be swapped for FEI in a UniSwapV2 liquidity pool. ProductControlled Value (PCV): Introduces a new concept where the protocol controls the value backing the stablecoin. Decentralized Governance: Managed by a DAO, allowing community participation in decisionmaking.

Use Cases

Stablecoin Transactions: FEI can be used for stable transactions without the need for centralized collateral. Governance Participation: TRIBE holders can vote on proposals affecting the FEI protocol. Liquidity Provision: Users can provide liquidity in the ETHFEI pool on Uniswap.

Recent Developments

Collateralization: FEI reserves are solid at 145% collateralization. Risk Management: The protocol has derisked by converting over 70,000 ETH into stablecoins. Community Activity: Despite the strong technological foundation, community engagement has been low, with inactive social channels and forums.

Market Impact

Demand and Adoption: The unique approach to stablecoin design could attract users looking for decentralized and stable assets. Market Position: Recent derisking and high collateralization strengthen its market position, but low community engagement could hinder growth. Future Growth: Potential for growth if community engagement improves and more use cases are developed.

Risks and Opportunities

Risks

Community Inactivity: Low engagement on social platforms could affect longterm sustainability. Market Volatility: Algorithmic stablecoins are inherently risky due to market volatility and liquidity issues.

Opportunities

Innovative Approach: The fractional reserve model and PCV concept offer a unique value proposition. Governance Participation: Active governance can lead to more robust and adaptive protocol development.

Community Engagement

Size and Activity: Currently low, with inactive social channels and forums. Engagement Strategies: Needs improvement to build a loyal and active user base.

Conclusion

Tribe and the FEI protocol present a compelling case for a decentralized stablecoin with a unique approach to maintaining stability. However, the project's success will heavily depend on improving community engagement and addressing the inherent risks of algorithmic stablecoins. Traders should consider the innovative aspects and current market position but remain cautious due to low community activity and potential volatility.

Considerations for Traders: Innovative Approach: Offers a unique solution in the stablecoin market. Market Position: Strong collateralization and risk management. Community Engagement: Needs improvement for sustained growth. Volatility: Be aware of the risks associated with algorithmic stablecoins.

This is not a financial advice. Please do your own research and consider the risks of trading cryptocurrencies.