News of Reserve Rights (RSR) - August 2024 Price Update - 8.93% Breakout Crypto News and Analysis

In an unexpected turn of events, Reserve Rights (RSR) experienced a significant price breakout on August 23, 2024, at precisely 14:07 UTC. The token surged by 8.93%, reaching a new price of $0.0065. This sudden spike has caught the attention of the crypto community, prompting a deeper look into the factors contributing to this remarkable movement. Reserve Rights, known for its dualtoken stablecoin protocol, has been making waves with its innovative approach to creating stablecoins backed by baskets of ERC20 tokens. This recent price action is a testament to the growing interest and potential of the project. On August 23, 2024, Reserve Rights (RSR) experienced a significant breakout, with its price surging by 8.93% to reach $0.0065. This sudden spike in value can be attributed to several key factors that have recently influenced the market dynamics of RSR. Let's delve into these reasons and explore the corresponding impacts through visual evidence to provide a comprehensive understanding of this breakout.

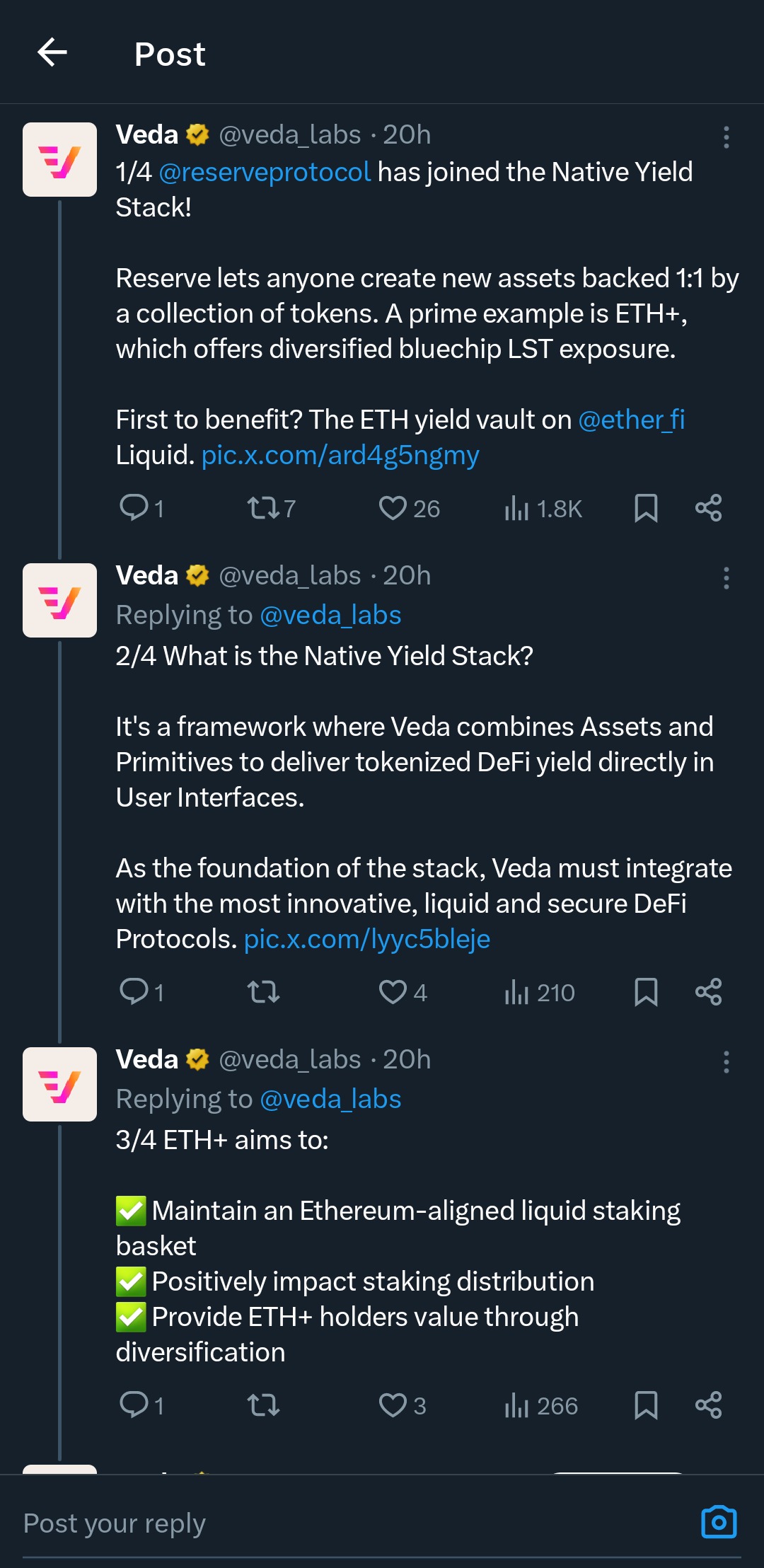

The first major reason for RSR's price surge is its integration with major DeFi protocols. This strategic move has diversified ETH liquid staking exposure and enhanced staking distribution, making RSR more appealing to investors and stakeholders.

Integration with major DeFi protocols: Veda's integration with Reserve Protocol is seen as a strategic move to diversify ETH liquid staking exposure and enhance staking distribution.

This integration has not only increased the usability of RSR but also expanded its market reach, attracting a broader audience and driving up demand.

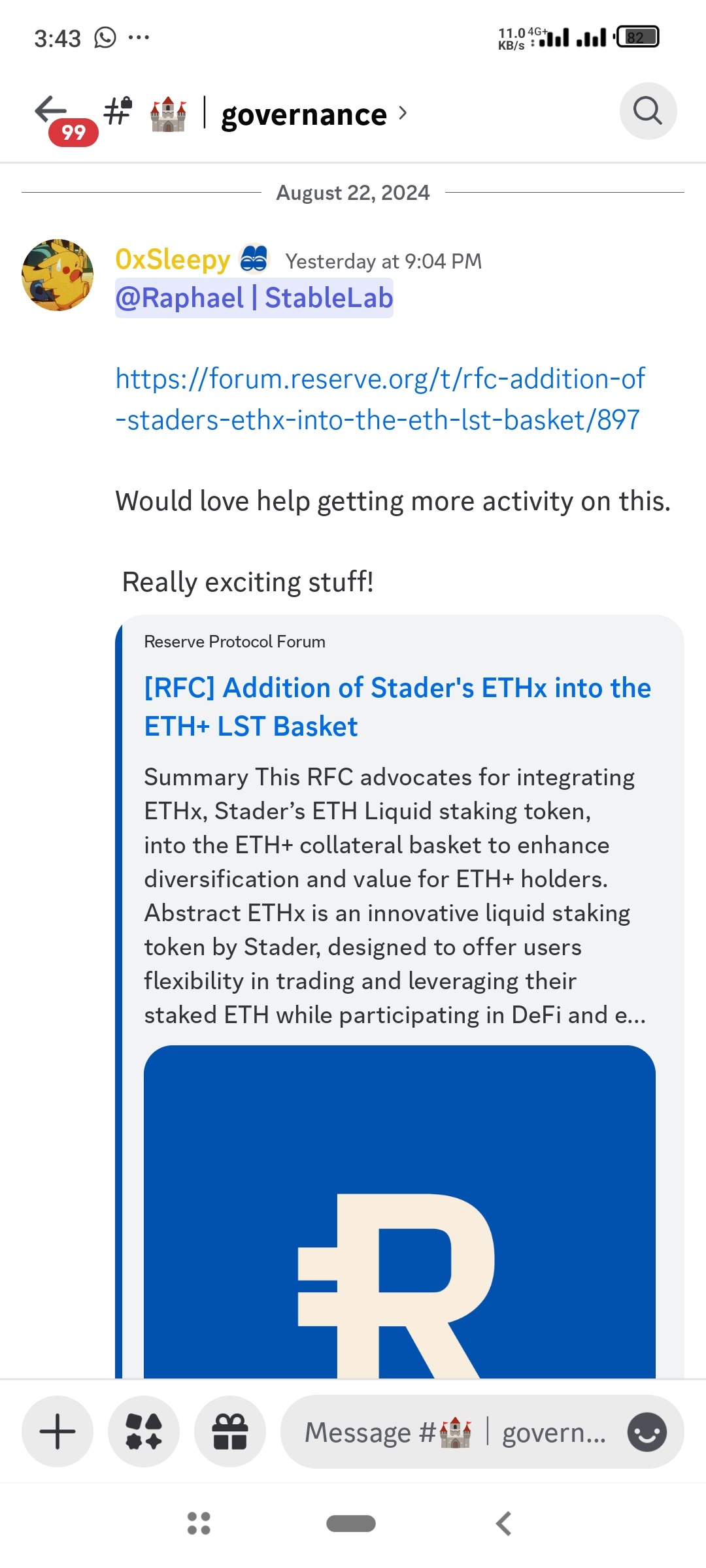

The second reason behind the breakout is the recent update on additional ETHx liquidity staking for token holders. This update has provided new staking opportunities, making RSR a more attractive option for investors looking to maximize their returns through staking.

ETH+ liquidity staking update: Recent updates on additional ETHx liquidity staking for token holders are contributing to the price pump, providing new staking opportunities.

These updates have significantly enhanced the value proposition of RSR, leading to increased investor confidence and a subsequent rise in its price.

In conclusion, the recent breakout of Reserve Rights (RSR) can be attributed to its strategic integration with major DeFi protocols and the introduction of new ETHx liquidity staking opportunities. These developments have not only improved the utility and market position of RSR but also attracted a wider audience, driving up demand and contributing to the price surge. As RSR continues to innovate and expand its reach, it is likely to see further growth and adoption in the cryptocurrency market. The recent breakout of Reserve Rights (RSR) can be attributed to strategic integrations and updates within the DeFi space. The collaboration with major DeFi protocols and the introduction of additional ETHx liquidity staking have significantly boosted investor confidence. As always, it's crucial for investors to conduct thorough research (DYOR) to navigate the complexities of the cryptocurrency market effectively.

We have asked 18 Experty community members questions related to "News of Reserve Rights (RSR) - August 2024 Price Update - 8.93% Breakout Crypto News and Analysis". We have received many valuable replies, the best ones (based on Experty community feedback) you can read below.

Interested in a specific topic?

Pick one keyword and dive into this theme

- reserve

- token

- protocol

- purpose

- eth

- platform

- holder

- ethereum

- lst

- native yield stack

- stack

- veda

- yield

- cryptocurrency

Explore the Core.

Reserve Rights (RSR) is an ERC-20 token that will serve two main purposes for the Reserve Protocol: overcollateralization of Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration. The Reserve Rights (RSR) token was launched in May 2019 following a successful initial exchange offering (IEO) on the Huobi Prime platform.

Spot the Main Event:

@reserveprotocol has joined the Native Yield Stack. Reserve lets anyone create new assets backed 1:1 by a collection of tokens. A prime example is ETH+, which offers diversified bluechip LST exposure. two main purposes for the Reserve Protocol: overcollateralization of Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration.

📸 Show Us What You Found:

Trade hard. Joy is coming

Explore the Core.

Reserve Rights (RSR) is an ERC-20 token that will serve two main purposes for the Reserve Protocol: overcollateralization of Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration. The Reserve Rights (RSR) token was launched in May 2019 following a successful initial exchange offering (IEO) on the Huobi Prime platform.

Spot the Main Event:

Veda thrilled about this integration with reserveprotocol, an exciting way to diversify ETH liquid staking exposure. To Maintain an Ethereum-aligned liquid staking basket Positively impact staking distribution and Provide ETH+ holders value through diversification

📸 Show Us What You Found:

Explore the Core.

Reserve Rights is a dual-token stablecoin protocol, consisting of the Reserve Rights token (RSR) and the Reserve stablecoin (RSV). RSR is used to stabilize RSV's value at $1 and allows holders to participate in governance. The protocol aims to reduce cryptocurrency volatility, making it suitable for global use, particularly in developing countries. It operates on Ethereum and plans to transition from a centralized to a decentralized system, ultimately allowing for a diverse asset-backed stablecoin ecosystem.

Spot the Main Event:

On the 22nd of August, 2024. Reserve Rights announced it has has joined the Native Yield Stack. Reserve lets anyone create new assets backed 1:1 by a collection of token. This a significant stride made.

📸 Show Us What You Found:

Explore the Core.

Reserve Rights (RSR) is an ERC-20 token that will serve two main purposes for the Reserve Protocol: overcollateralization of Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration. The Reserve Rights (RSR) token was launched in May 2019 following a successful initial exchange offering (IEO) on the Huobi Prime platform.

Spot the Main Event:

reserveprotocol has joined the Native Yield Stack! Reserve lets anyone create new assets backed 1:1 by a collection of tokens. A prime example is ETH+, which offers diversified bluechip LST exposure.

📸 Show Us What You Found:

To God be the Glory

Explore the Core.

Reserve Rights (RSR) is an ERC-20 token that will serve two main purposes for the Reserve Protocol: overcollateralization of Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration. The Reserve Rights (RSR) token was launched in May 2019 following a successful initial exchange offering (IEO) on the Huobi Prime platform.

Spot the Main Event:

The Veda is thrilled about this integration with @reserveprotocol, an exciting way to diversify ETH liquid staking exposure. It's a framework where Veda combines Assets and Primitives to deliver tokenized DeFi yield directly in User Interfaces. As the foundation of the stack, Veda must integrate with the most innovative, liquid and secure DeFi Protocols.

📸 Show Us What You Found:

Freelancer , Copy Writer and Crypto lover

Explore the Core.

Reserve Rights (RSR) is an ERC-20 token that will serve two main purposes for the Reserve Protocol: overcollateralization of Reserve stablecoins (RTokens) through staking and governing them through proposing & voting on changes to their configuration. The Reserve Rights (RSR) token was launched in May 2019 following a successful initial exchange offering (IEO) on the Huobi Prime platform.

Spot the Main Event:

The price pump is related to it's integration on ETH more so there's a recent update on additional ETHx liquidity staking for the token holders.

📸 Show Us What You Found:

Overview

Reserve Protocol is a decentralized platform designed to create stablecoins backed by baskets of ERC20 tokens on Ethereum, Base, and Arbitrum. These stablecoins, known as RTokens, aim to provide a stable and reliable digital currency resistant to inflation and volatility. The project distinguishes itself by offering a decentralized, assetbacked stablecoin ecosystem, which is particularly beneficial for global use, especially in developing countries.

Key Features

AssetBacked Stablecoins (RTokens): RTokens are backed by a diverse basket of ERC20 tokens, providing stability and reducing volatility. DualToken System: Utilizes Reserve Rights (RSR) for overcollateralization and governance, and Reserve stablecoin (RSV) for transactions. Permissionless Platform: Allows users to mint and redeem RTokens onchain without intermediaries. DeFi Integration: RTokens can be used in various DeFi applications, offering passive yields without staking or locking up tokens. Global Accessibility: Aims to provide a stable digital currency for crossborder payments and financial inclusion.

Use Cases

Global Payments: Facilitates crossborder transactions without the need for traditional banking intermediaries. DeFi Applications: Integrates with lending platforms, decentralized exchanges, and derivatives markets. Gaming and Metaverse: Provides a stable ingame currency for virtual worlds. Supply Chain Finance: Streamlines transactions, reducing fraud and improving efficiency.

Recent Developments

Native Yield Stack Integration: Reserve Protocol has joined the Native Yield Stack, enhancing its DeFi capabilities. Partnership with Veda: Integration with Veda to diversify ETH liquid staking exposure. Community Engagement: Active discussions and events on platforms like Twitter and Discord, including live video sessions with industry experts.

Market Impact

Increased Adoption: Growing user base and transaction volume indicate rising acceptance and trust in the protocol. DeFi Integration: Enhanced DeFi capabilities through partnerships and integrations could drive demand for RTokens. Stable Peg Maintenance: Successfully maintaining a stable peg to fiat currencies like the US dollar boosts credibility and market presence.

Risks and Opportunities

Risks

Security Breaches: Potential vulnerabilities in smart contracts could pose risks. Regulatory Challenges: Navigating complex regulatory landscapes could impact operations. Community Activity: Limited active community engagement could hinder growth.

Opportunities

DeFi Expansion: Increasing integration with DeFi platforms offers significant growth potential. Global Financial Inclusion: Providing a stable currency for unbanked populations can drive widespread adoption. Technological Innovations: Continuous improvements and new features can enhance the platform's appeal.

Community Engagement

Community Size: Moderate, with active discussions on Twitter and Discord. Engagement Strategies: Regular updates, live video sessions, and collaborations with industry experts. Events and Contests: Hosting meetups, contests, and giveaways to boost community involvement.

Conclusion

Reserve Protocol presents a compelling investment opportunity with its innovative approach to creating stable, assetbacked digital currencies. The project's focus on DeFi integration, global accessibility, and financial inclusion positions it well for future growth. However, traders should consider potential risks such as security vulnerabilities and regulatory challenges. Overall, Reserve Protocol's unique value proposition and recent developments make it a noteworthy contender in the cryptocurrency market.

This is not a financial advice. Please do your own research and consider the risks of trading cryptocurrencies.