Pendle - May 2024 Price Update - 7% Breakout News and Analysis

On May 25, 2024, at precisely 03:37 AM UTC, Pendle (PENDLE) experienced a significant breakout, surging by approximately 7% to reach a new price of $7.07. This sudden price movement has captured the attention of investors and analysts alike, prompting a closer look at the factors contributing to this remarkable rise. Several key reasons contributed to Pendle's impressive price surge. Let's delve into each factor with supporting visuals to understand the dynamics behind this breakout.

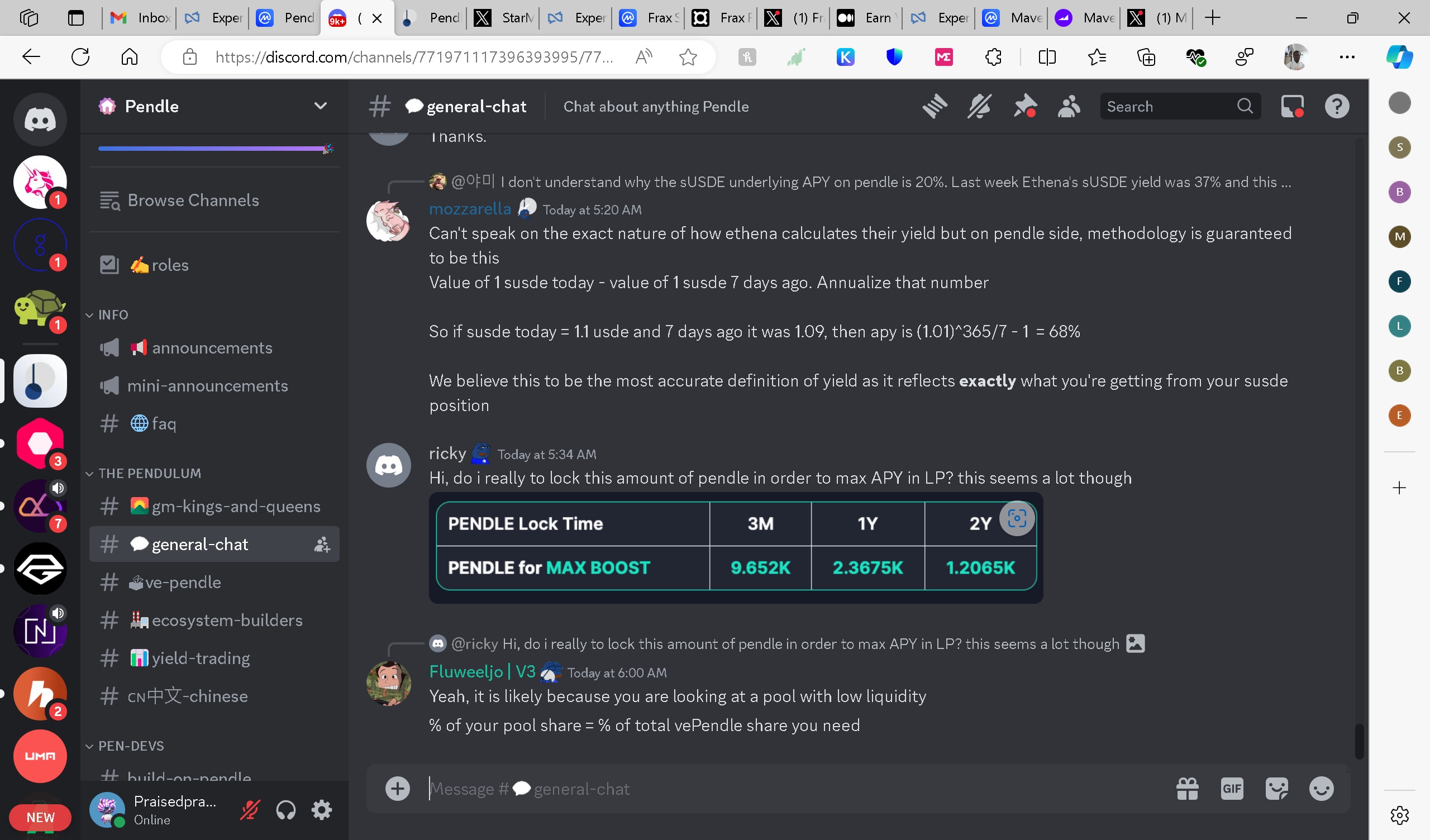

Puffer Finance airdrop and multiplier points: The recent airdrop collaboration with Puffer Finance and the increase in multiplier points encourage more users to stake assets, generate fees, and grow the community.

Pendle's innovative approach to yield tokenization and trading has positioned it as a leader in the DeFi space. By allowing users to separate the principal amount of their asset from its future yield, Pendle provides unprecedented flexibility and control over yield management. This unique feature has attracted a wide range of DeFi participants, further boosting its market position.

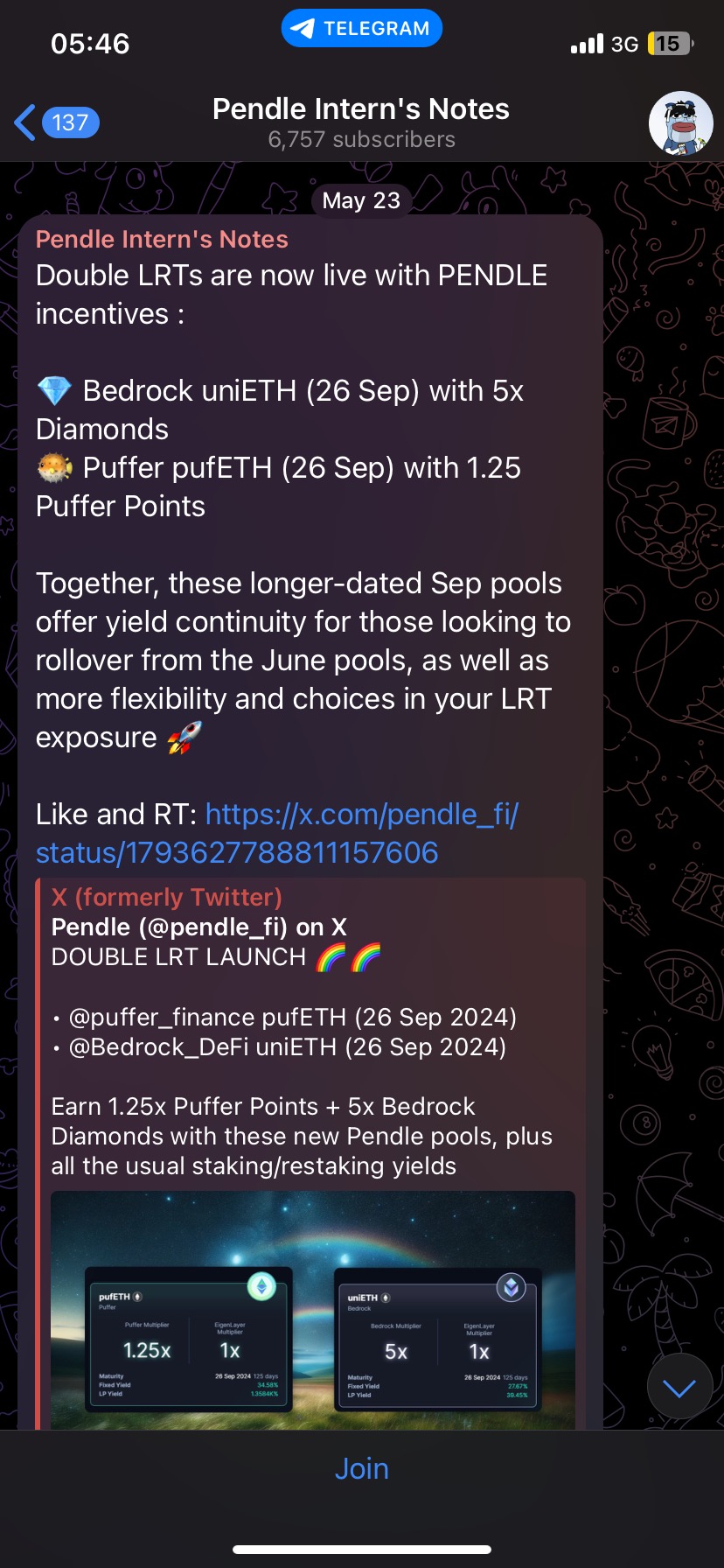

Double LRTs launch with incentives: The introduction of Double LRTs (Liquidity Rewards Tokens) with substantial incentives such as 5x Bedrock Diamonds and 1.25x Puffer Points has significantly increased user engagement and participation.

These strategic initiatives have not only enhanced Pendle's usability but also expanded its market reach. The community's positive reception and active participation in these new pools indicate strong confidence in Pendle's longterm potential.

Integration with major DeFi protocols: Successful integrations with prominent DeFi protocols, such as Venus, have unlocked additional utility for Pendle users, allowing them to leverage their tokens for staking and borrowing.

These integrations have provided Pendle users with more options and increased the overall value proposition of Pendle tokens. The enhanced utility and broader adoption of Pendle's yield tokenization functionalities have played a crucial role in driving its price upward.

Overview

Pendle is a pioneering protocol in the decentralized finance (DeFi) ecosystem, focusing on the tokenization and trading of future yield. By allowing users to separate the ownership of the underlying asset from its future yield, Pendle introduces innovative financial instruments that enhance flexibility and strategic asset management. This unique approach sets Pendle apart in the crowded cryptocurrency market, offering users advanced tools to maximize earnings and manage risk.

Key Features

Yield Tokenization

Standardized Yield Tokens (SY): Pendle wraps yieldbearing tokens into SY tokens, representing both the underlying asset and its future yield. Separation of Principal and Yield: Users can split their assets into Principal Tokens (PT) and Yield Tokens (YT), enabling independent management and trading.

Automated Market Maker (AMM)

Time Decay Support: Pendle's AMM is tailored for assets with time decay, facilitating efficient trading of PT and YT tokens. Permissionless Trading: Users can trade PT and YT tokens freely on DeFi exchanges, enhancing liquidity and market participation.

Use Cases

Staking: Secures the network and rewards participants, aligning user interests with network health. Yield Farming: Allows users to earn rewards by leveraging yieldbearing assets. Governance: vePENDLE holders govern the platform and receive a share of the protocol's revenue. Liquidity Provision: Enhances overall DeFi liquidity by unlocking yield from locked assets.

Recent Developments

New High in TVL: As of May 2024, Pendle's Total Value Locked (TVL) reached $5.74 billion. Double LRT Launch: Introduction of new liquidity pools (pufETH and uniETH) with enhanced incentives. Partnerships: Collaborations with entities like Redacted Cartel/Dinero and Puffer Finance. Multichain Expansion: Pendle is now live on Ethereum, Arbitrum, BNB Smart Chain, and Optimism. Exchange Listings: $PENDLE token listed on major exchanges including Binance, Kucoin, and Uniswap.

Market Impact

Increased Liquidity: Unlocking yield from locked assets improves overall DeFi liquidity. Enhanced User Control: Separation of principal and yield offers users more control and advanced yield strategies. Wider Adoption: Successful integrations and partnerships signal broader acceptance and use of Pendle's technology. Growing TVL: Indicates strong user trust and engagement, positioning Pendle as a significant player in the DeFi space.

Risks and Opportunities

Risks

Security Concerns: As with any DeFi protocol, potential vulnerabilities could pose risks. Market Volatility: Fluctuations in the crypto market could impact Pendle's token value and user engagement.

Opportunities

Innovative Yield Strategies: Pendle's unique approach to yield management could attract a diverse range of DeFi participants. Growing Ecosystem: Continued partnerships and integrations could expand Pendle's market presence and user base. Enhanced User Experience: Simplified yield generation and flexible strategies could drive wider adoption among new DeFi users.

Community Engagement

Active Community: Pendle boasts a vibrant community across platforms like Discord, Telegram, and Twitter. Engagement Strategies: Regular updates, incentives, and educational content keep the community informed and engaged. Developer Interest: A growing developer community indicates strong interest in Pendle's potential for future innovation.

Conclusion

Pendle's innovative approach to tokenizing and trading future yield positions it as a compelling choice for traders and investors. With significant recent developments, strong market impact, and active community engagement, Pendle demonstrates potential for sustained growth and adoption in the DeFi space. Traders should consider Pendle's unique value proposition, market position, and the opportunities it presents for advanced yield strategies and liquidity management.

Summary

In summary, Pendle's recent price breakout can be attributed to several strategic and technological developments. The Puffer Finance airdrop, the launch of Double LRTs with attractive incentives, and successful integrations with major DeFi protocols have collectively contributed to this surge. These advancements highlight Pendle's innovative approach and its growing influence in the DeFi space. As always, it is essential for investors to conduct thorough research (DYOR) to navigate the complexities of the cryptocurrency market effectively.

Please Do Your Own Research always! We are not financial advisors, any information provided in this article is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we present is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.