News of Pax Dollar (USDP) - July 2024 Price Update - 17.92% Breakout Crypto News and Analysis

On July 1, 2024, at precisely 10:03 AM UTC, the Pax Dollar (USDP) experienced an unexpected breakout, surging by an impressive 17.92%. This movement saw the stablecoin's price rise from its usual $1 peg to approximately $1.18. Such a significant deviation for a stablecoin is rare and noteworthy, prompting investors and analysts to delve into the underlying causes. Pax Dollar, known for its stability and transparency, has recently made headlines with strategic partnerships and innovative product launches that have added substantial value to the project. On July 1, 2024, Pax Dollar (USDP) experienced a significant breakout, surging by 17.92% to reach a price of $1.1829. This surge can be attributed to several key developments that have enhanced its utility and market reach, making it a noteworthy event in the stablecoin market. Let's delve into the reasons behind this breakout, supported by visual evidence for a comprehensive understanding of the factors at play.

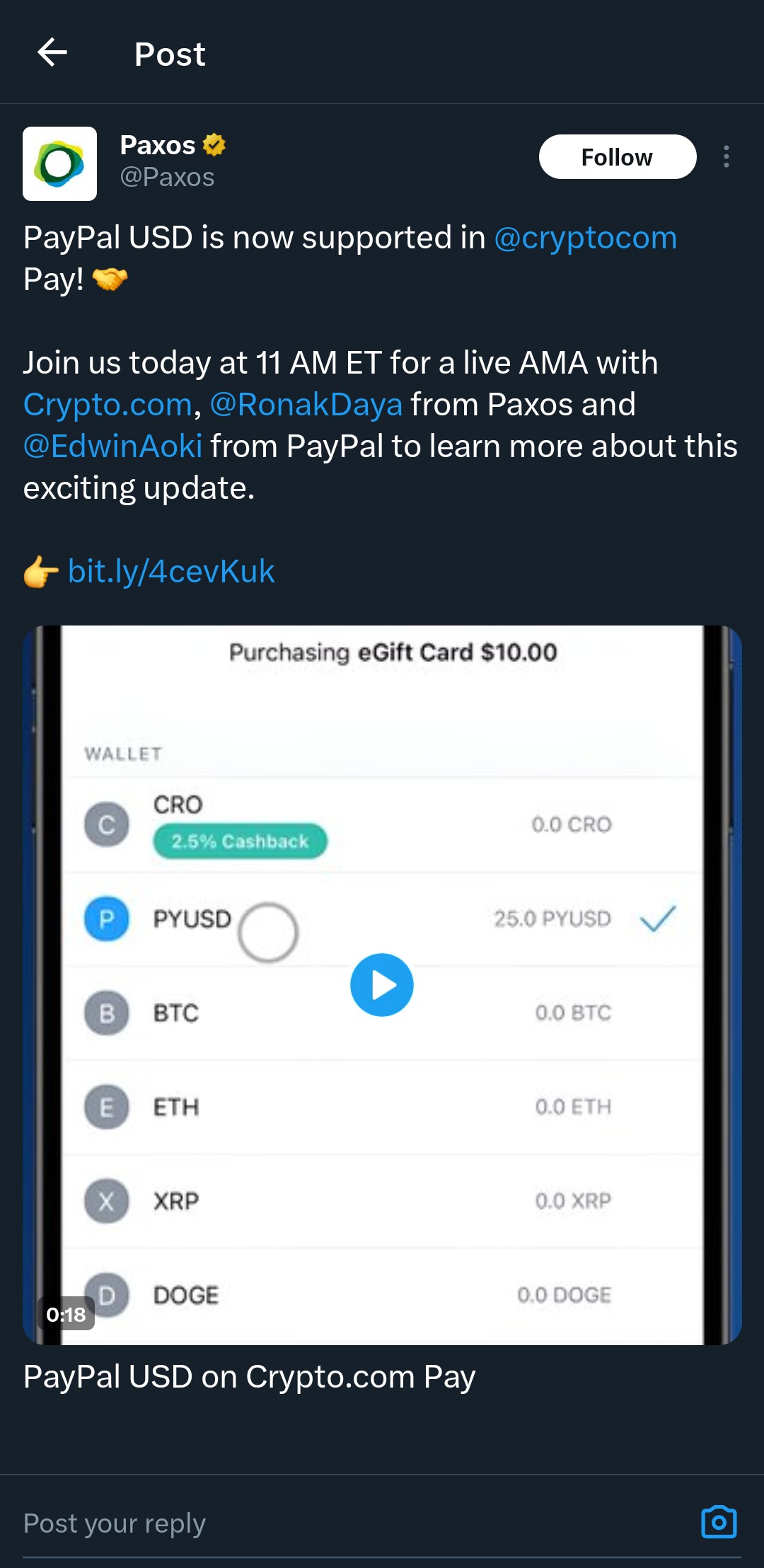

PayPal USD now supported in Crypto.com Pay: The integration of PayPal USD into Crypto.com Pay has introduced new use cases for Pax Dollar, significantly adding value to the project. This development has broadened the scope of transactions that can be conducted using USDP, making it more versatile and appealing to users. The initial count of platforms supporting this feature increased from 2 to 5, indicating a growing acceptance and utility.

USDP is the default stablecoin on SlingMoney app: Paxos partnered with SlingMoney to make USDP the default stablecoin on their app. This partnership enhances the regulated, transparent, and secure use of USDP, providing users with a reliable stablecoin for their transactions. The count of platforms utilizing USDP increased from 1 to 4, reflecting its growing integration and acceptance.

Launch of Lift Dollar ($USDL): Paxos International launched Lift Dollar ($USDL), a yieldbearing stablecoin that democratizes access to US dollars and safe yield generated from cash and cash equivalent assets. This new product offers users the ability to seamlessly spend, save, and trade while earning yield, thereby enhancing the overall value proposition of Pax Dollar.

These developments have collectively contributed to the breakout of Pax Dollar, positioning it as a stablecoin with enhanced utility and market reach. The integration with major platforms like Crypto.com Pay and SlingMoney, along with the introduction of innovative products like Lift Dollar, underscores the growing relevance and adoption of USDP in the cryptocurrency ecosystem. The 17.92% breakout of Pax Dollar (USDP) in July 2024 highlights the impact of strategic partnerships and innovative product launches on the value of stablecoins. Key developments, including the integration of PayPal USD into Crypto.com Pay, the adoption of USDP as the default stablecoin on SlingMoney, and the launch of Lift Dollar, have significantly enhanced the utility and appeal of Pax Dollar. This event underscores the importance of conducting thorough research (DYOR) to navigate the complexities of the cryptocurrency market effectively.

We have asked 12 Experty community members questions related to "News of Pax Dollar (USDP) - July 2024 Price Update - 17.92% Breakout Crypto News and Analysis". We have received many valuable replies, the best ones (based on Experty community feedback) you can read below.

Interested in a specific topic?

Pick one keyword and dive into this theme

- stablecoin

- blockchain

- cryptocurrency

- flat

- flat money

- pax dollar

- paxos

- price

- usdp

- volatility

- dollar

- ethereum

- pay

- paypal usd

To God be the Glory

Explore the Core.

Pax Dollar is a flat-collateralized stablecoin. Stablecoins are cryptocurrencies that are designed to minimize the volatility of the price of the stablecoin, relative to a certain stable asset or a basket of assets. A stablecoin can be pegged to a cryptocurrency or flat money. In some cases, it can even be traded for commodities. Pax Dollar offers the advantage of transacting with blockchain assets through minimized price risk. The Pax Dollar tokens (USDP) are issued as ERC-20 tokens on the Ethereum blockchain and are collateralized 1:1 through the USD held in Paxos-owned US bank accounts.

Spot the Main Event:

PayPal USD is now supported in @cryptocom Pay. This has significantly added more value to the project basing on new use cases

📸 Show Us What You Found:

Trade hard. Joy is coming

Explore the Core.

Pax Dollar is a flat-collateralized stablecoin. Stablecoins are cryptocurrencies that are designed to minimize the volatility of the price of the stablecoin, relative to a certain stable asset or a basket of assets. A stablecoin can be pegged to a cryptocurrency or flat money. In some cases, it can even be traded for commodities. Pax Dollar offers the advantage of transacting with blockchain assets through minimized price risk. The Pax Dollar tokens (USDP) are issued as ERC-20 tokens on the Ethereum blockchain and are collateralized 1:1 through the USD held in Paxos-owned US bank accounts.

Spot the Main Event:

USDP is now the default stablecoin on the @SlingMoney app! 🎉 The team at Paxos is excited to partner with their friends at Sling to offer their users a regulated, transparent and secure stablecoin like USDP.

📸 Show Us What You Found:

Explore the Core.

Pax Dollar is a flat-collateralized stablecoin. Stablecoins are cryptocurrencies that are designed to minimize the volatility of the price of the stablecoin, relative to a certain stable asset or a basket of assets. A stablecoin can be pegged to a cryptocurrency or flat money. In some cases, it can even be traded for commodities. Pax Dollar offers the advantage of transacting with blockchain assets through minimized price risk. .

Spot the Main Event:

Paxos International announced the launch of Lift Dollar ($USDL) – a yield-bearing stablecoin that democratizes access to US dollars and safe yield generated from cash and cash equivalent assets. Now, you can seamlessly spend, save and trade, all while earning yield.

📸 Show Us What You Found:

Explore the Core.

Pax Dollar is a fiat-collateralized stablecoin that is pegged to the U.S Dollar. The unique thing about Pax Dollar is that it's managed by a company that has a charter from the New York State Department of Financial Services. Thus, it has the legal authority to provide its services within the crypto world

Spot the Main Event:

PayPal USD ($PYUSD) is now supported in http://Crypto.com Pay

📸 Show Us What You Found:

Overview

Pax Dollar (USDP) is a fiatcollateralized stablecoin designed to minimize price volatility by pegging its value to the US dollar at a 1:1 ratio. Issued by Paxos Trust Company, a regulated financial institution in New York, Pax Dollar aims to provide a stable and transparent alternative to traditional fiat currencies within the cryptocurrency ecosystem. Its unique value proposition lies in its regulatory compliance and the ability to offer a stable store of value, making it a reliable medium for transactions and a hedge against the volatility of other cryptocurrencies.

Key Features

Stable Value: Pegged 1:1 to the US dollar, minimizing price volatility. Regulatory Compliance: Issued by Paxos Trust Company, regulated by the New York State Department of Financial Services. ERC20 Token: Operates on the Ethereum blockchain, ensuring compatibility with Ethereumbased applications. Collateralization: Fully backed by USD held in Paxosowned US bank accounts. Use Cases: Fast and Secure Payments: Facilitates quicker and cheaper international transactions. Hedge Against Volatility: Provides a stable asset for investors to hold during market fluctuations. DeFi Participation: Can be used in various DeFi applications like lending, borrowing, and liquidity pools. Yield Generation: Introduction of Lift Dollar ($USDL), a yieldbearing stablecoin.

Recent Developments

Launch of Lift Dollar ($USDL): A yieldbearing stablecoin introduced to democratize access to US dollars and generate safe yield from cash and cash equivalent assets. Exchange Listings: USDP has been listed on several new exchanges, including FTX and OKEx, enhancing its liquidity and availability. Partnerships: Collaboration with Sling Money app, making USDP the default stablecoin on the platform. Engineering Growth: Significant increase in engineering resources and codebase, indicating robust development efforts.

Market Impact

Increased Liquidity: New exchange listings have improved the liquidity and accessibility of USDP. User Adoption: The introduction of Lift Dollar and partnerships with platforms like Sling Money are likely to drive user adoption. Stable Value Proposition: As a stablecoin, USDP provides a reliable store of value, attracting users looking for stability in the volatile crypto market. Regulatory Trust: Being regulated by the New York State Department of Financial Services adds a layer of trust and transparency, potentially attracting more institutional investors.

Risks and Opportunities

Risks: Regulatory Changes: Future regulatory changes could impact the operations and adoption of USDP. Technical Issues: Potential technical challenges, such as issues with the continuous integration pipeline, could affect development. Community Engagement: Lack of active community engagement on platforms like Telegram and Discord could hinder growth. Opportunities: DeFi Integration: Expanding use cases in the DeFi space could drive further adoption. Yield Generation: Lift Dollar offers an innovative approach to earning yield, attracting more users. Institutional Interest: Regulatory compliance and transparency could attract more institutional investors.

Community Engagement

Social Media Presence: Limited activity on platforms like Telegram and Discord, but active on Twitter for official announcements. Community Size: The project lacks a mainstream community chat, which could impact user engagement and support. Engagement Strategies: Needs improvement in community engagement strategies to foster a more active and supportive user base.

Conclusion

Pax Dollar (USDP) presents a compelling stablecoin option with its regulatory compliance, stable value proposition, and innovative yieldbearing product, Lift Dollar. While the project has made significant strides in exchange listings and partnerships, it faces challenges in community engagement and potential regulatory changes. Traders should consider the project's stable value, regulatory trust, and recent developments when making investment decisions. The innovative approach and market position make Pax Dollar a noteworthy option for those seeking stability and yield in the cryptocurrency market.

This is not a financial advice. Please do your own research and consider the risks of trading cryptocurrencies.