News of Liquity (LQTY) - August 2024 Price Update - 7.42% Breakout Crypto News and Analysis

On August 23, 2024, at precisely 20:27 UTC, the cryptocurrency market witnessed a significant breakout as Liquity (LQTY) surged by 7.42%, reaching a notable price of $0.92. This decentralized borrowing protocol, built on Ethereum, has been making waves with its unique approach to interestfree loans and the introduction of its stablecoin, LUSD. But what sparked this sudden rise in LQTY's value? Let's dive into the details and explore the key factors behind this breakout. On August 23, 2024, Liquity (LQTY) experienced a significant breakout, with its price surging by 7.42% to reach $0.9216. This remarkable performance can be attributed to several key factors that have positively influenced the market's perception of the cryptocurrency. Let's delve into the reasons behind this breakout and explore the impact of each development on Liquity's market position and future prospects.

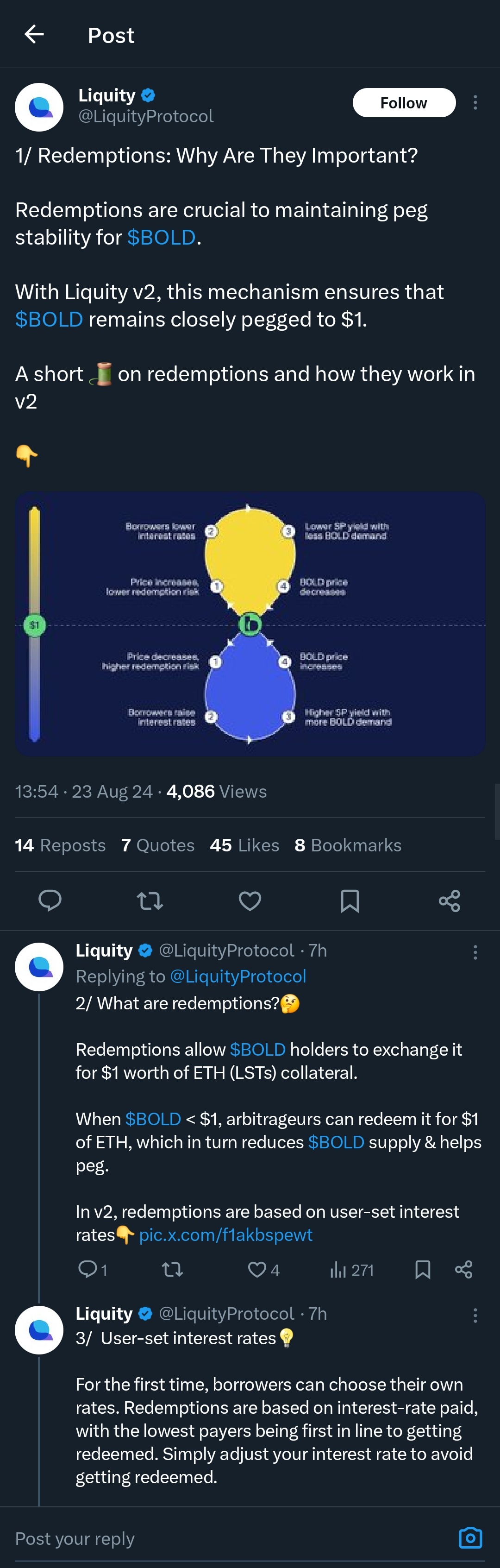

The first major catalyst for Liquity's breakout was the announcement of Liquity v2 and the deployment of $BOLD on the mainnet. The team confirmed the mainnet deployment of Liquity v2 and $BOLD, emphasizing adaptive redemptions to improve collateral health. This announcement generated substantial excitement within the community and among investors, as it promised significant enhancements to the protocol's functionality and stability.

Team announces Liquity v2 and $BOLD deployment on mainnet:

Another crucial factor contributing to the breakout was the positive market sentiment driven by favorable outcomes from the Federal Open Market Committee (FOMC) meeting. The FOMC meeting indicated a favorable rate cut for September, leading to a positive market sentiment. This broader market optimism spilled over into the cryptocurrency sector, benefiting assets like Liquity.

Positive market sentiment due to favorable FOMC meeting outcomes:

Additionally, Liquity's innovative features and planned improvements for the token played a significant role in driving its price upward. The team is planning new innovations and improvements for the token, aimed at benefiting token holders and investors. These planned enhancements have bolstered investor confidence and attracted new participants to the ecosystem.

Innovative features and improvements planned for the token:

In conclusion, Liquity's recent breakout can be attributed to a combination of strategic announcements, favorable macroeconomic conditions, and the promise of innovative features. The deployment of Liquity v2 and $BOLD on the mainnet, coupled with positive market sentiment and planned improvements, has positioned Liquity as a promising player in the decentralized finance (DeFi) space. As the protocol continues to evolve and adapt to market conditions, it is likely to attract further attention and investment, solidifying its place in the evergrowing DeFi ecosystem.

We have asked 18 Experty community members questions related to "News of Liquity (LQTY) - August 2024 Price Update - 7.42% Breakout Crypto News and Analysis". We have received many valuable replies, the best ones (based on Experty community feedback) you can read below.

Interested in a specific topic?

Pick one keyword and dive into this theme

To God be the Glory

Spot the Main Event:

They are deploying Liquity v2 and $BOLD on mainnet. v2 also introduces adaptive redemptions, where collateral deemed most risky to $BOLD’s backing is redeemed first. This helps improve the health of collateral branches with higher "outside" debt (debt not covered by their SP)

📸 Show Us What You Found:

Explore the Core.

Liquity is a decentralized borrowing protocol built on Ethereum that utilizes LQTY, a USD-pegged stablecoin. Ether holders can draw loans in the form of LQTY with algorithmically adjusted redemption and loan issuance fees.

Abdullahi Saleh SaiduCute, funny and a little bit crazy!!!

Explore the Core.

Liquity is a decentralized borrowing protocol built on Ethereum that utilizes LQTY, a USD-pegged stablecoin. Ether holders can draw loans in the form of LQTY with algorithmically adjusted redemption and loan issuance fees. Liquity is a decentralized borrowing protocol that enables users to secure interest-free loans using Ether (ETH) as collateral. This innovative platform introduces a stablecoin, LUSD, pegged to the USD, which borrowers receive as the loan amount. What sets Liquity apart from other borrowing protocols is its unique approach to interest and governance. Unlike traditional lending platforms that charge ongoing interest, Liquity only imposes a one-time fee of 0.5% on loans issued in LUSD. This feature makes it an attractive option for users looking to leverage their ETH holdings without the burden of accruing interest over time. Additionally, Liquity maintains a minimum collateral ratio of 110%, ensuring a buffer against market volatility and protecting the protocol's stability.

Spot the Main Event:

Redemptions: Why Are They Important? Redemptions are crucial to maintaining peg stability for $BOLD. With Liquity v2, this mechanism ensures that $BOLD remains closely pegged to $1. Redemptions allow $BOLD holders to exchange it for $1 worth of ETH (LSTs) collateral. When $BOLD < $1, arbitrageurs can redeem it for $1 of ETH, which in turn reduces $BOLD supply & helps peg. In v2, redemptions are based on user-set interest rates. For the first time, borrowers can choose their own rates. Redemptions are based on interest-rate paid, with the lowest payers being first in line to getting redeemed. Simply adjust your interest rate to avoid getting redeemed. v2 also introduces adaptive redemptions, where collateral deemed most risky to $BOLD’s backing is redeemed first. This helps improve the health of collateral branches with higher "outside" debt (debt not covered by their SP). As users increase their interest rates, they drive up the yield for holding $BOLD, making it more attractive. This is because v2 directs the majority of its protocol revenue toward growing $BOLD. In v2, redemptions don’t just maintain $BOLD’s peg—they’re a safeguard that adapts to market conditions. By aligning redemptions with user-set interest rates, Liquity v2 offers a sustainable, decentralized way to restore stablecoin value. Actual, DeFi.

📸 Show Us What You Found:

Explore the Core.

Liquity is a decentralized borrowing protocol built on Ethereum that utilizes LQTY, a USD-pegged stablecoin. Ether holders can draw loans in the form of LQTY with algorithmically adjusted redemption and loan issuance fees.

Spot the Main Event:

Liquity v2 offers a sustainable, decentralized way to restore stablecoin value.

📸 Show Us What You Found:

Explore the Core.

Liquity is a decentralized borrowing protocol that enables users to secure interest-free loans using Ether (ETH) as collateral. This innovative platform introduces a stablecoin, LUSD, pegged to the USD, which borrowers receive as the loan amount. What sets Liquity apart from other borrowing protocols is its unique approach to interest and governance.

Spot the Main Event:

They are deploying Liquity v2 and $BOLD on mainnet. v2 also introduces adaptive redemptions, where collateral deemed most risky to $BOLD’s backing is redeemed first. This helps improve the health of collateral branches with higher "outside" debt (debt not covered by their SP).

📸 Show Us What You Found:

A dedicated learner!

Explore the Core.

Liquity is a decentralized borrowing protocol built on Ethereum. It allows users to take out 0% interest loans against their Ether collateral, with loans paid out in a stablecoin called LUSD. The LQTY token is used to capture fee revenue generated by the Liquity protocol via staking.

Spot the Main Event:

Some exciting announcement by the team! According to them, they will be deploying Liquity v2 and $Bold on the mainnet. Also, they will be envisioning a wider ecosystem of aligned friendly forks across different networks and assets.

📸 Show Us What You Found:

Trade hard. Joy is coming

Explore the Core.

Liquity is a decentralized borrowing protocol built on Ethereum that utilizes LQTY, a USD-pegged stablecoin. Ether holders can draw loans in the form of LQTY with algorithmically adjusted redemption and loan issuance fees.

Spot the Main Event:

They are deploying Liquity v2 and $BOLD on mainnet. v2 also introduces adaptive redemptions, where collateral deemed most risky to $BOLD’s backing is redeemed first. This helps improve the health of collateral branches with higher "outside" debt (debt not covered by their SP), With v2, their focusing on the original idea behind DeFi stablecoins: autonomous borrowing facilities.

📸 Show Us What You Found:

Overview

Liquity is a decentralized borrowing protocol built on Ethereum, enabling users to secure interestfree loans using Ether (ETH) as collateral. The platform introduces a stablecoin, LUSD, pegged to the USD, which borrowers receive as the loan amount. Liquity stands out in the crowded cryptocurrency market due to its unique approach to interest and governance, imposing only a onetime fee of 0.5% on loans and maintaining a minimum collateral ratio of 110%. This ensures a buffer against market volatility and protects the protocol's stability.

Key Features

InterestFree Loans: Users can borrow LUSD against their ETH collateral without ongoing interest, only paying a onetime fee of 0.5%. Minimum Collateral Ratio: A 110% collateral ratio ensures stability and protection against market volatility. NonCustodial: Users retain full control over their collateral, enhancing security and trust. Immutable Infrastructure: Operates without a governance system, relying on algorithmic adjustments to fees. Liquidation Mechanism: Automatically adjusts to maintain protocol health and stability in case of collateral value drops. Stability Providers and Stakers: Rewards for contributing to the ecosystem's resilience.

Use Cases: Leverage ETH Holdings: Borrowers can leverage their ETH without the burden of accruing interest. Stablecoin Transactions: LUSD can be used for transactions, providing a stable value pegged to USD. DeFi Integration: Integrates with other DeFi platforms for various financial services.

Recent Developments

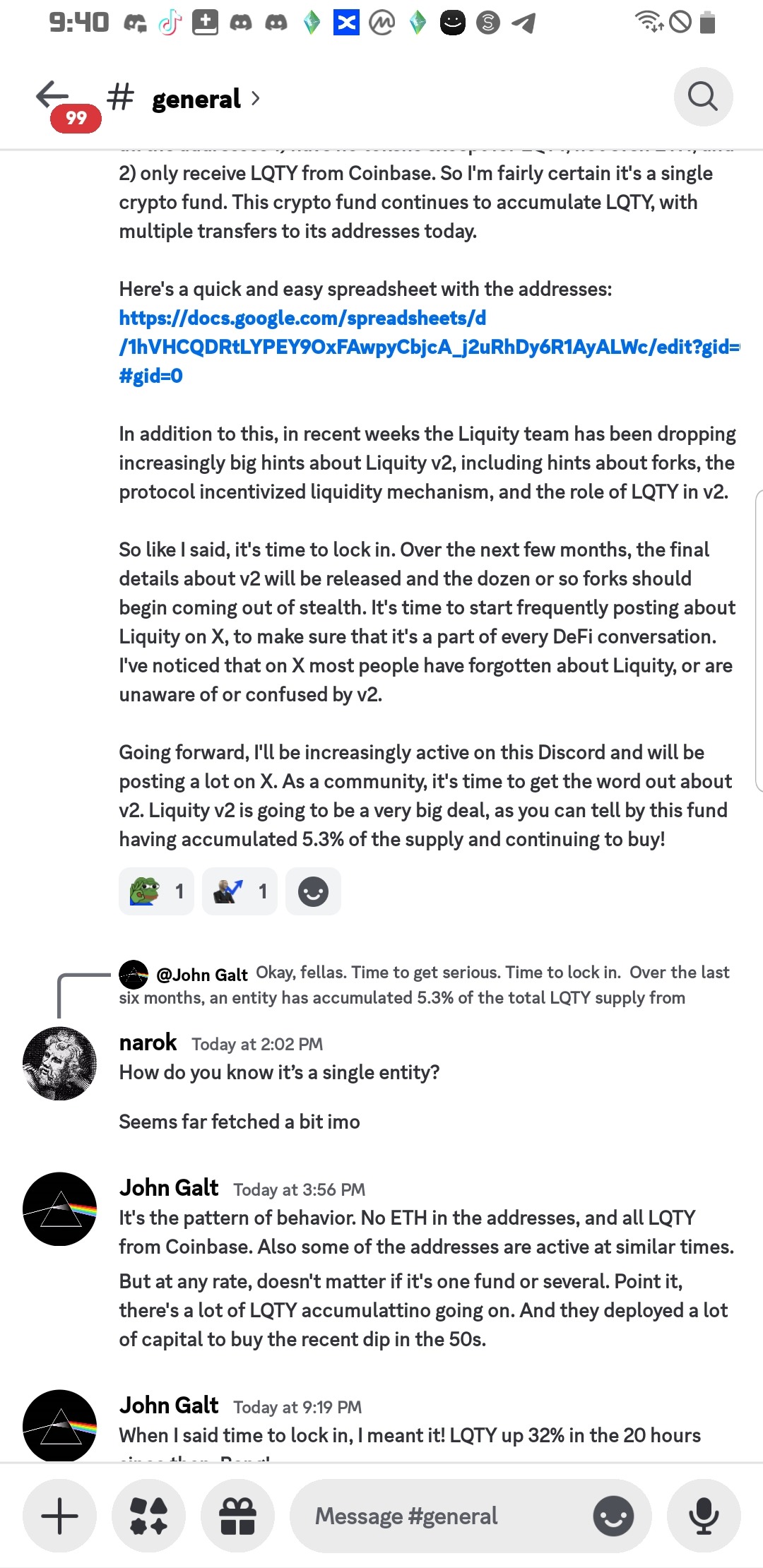

Liquity v2 Launch: Introduction of Liquity v2, which aims to revolutionize the stablecoin industry with features like adaptive redemptions and improved collateral health. $BOLD Deployment: Launch of $BOLD on mainnet, ensuring peg stability through adaptive redemptions. Community Growth: Onboarding of 15 skilled DeFi teams to collaborate on expanding the protocol. Crypto Fund Accumulation: A significant entity has accumulated 5.3% of the total LQTY supply from Coinbase, indicating strong institutional interest.

Market Impact

Increased Demand: The unique features and recent developments are likely to drive higher demand for LUSD and LQTY. User Adoption: The interestfree loan model and robust collateral management could attract more users, enhancing market presence. Institutional Interest: Accumulation by a crypto fund suggests potential for significant future growth and stability.

Risks and Opportunities

Risks: Market Volatility: Despite the 110% collateral ratio, extreme market conditions could pose risks. Security Concerns: As with any DeFi protocol, potential vulnerabilities could be exploited.

Opportunities: Innovative DeFi Solutions: Liquity's unique approach offers new opportunities for traders and investors. Community and Institutional Support: Strong community engagement and institutional interest could drive longterm growth.

Community Engagement

Active Social Media Presence: Regular updates and discussions on Twitter, Discord, and Telegram. Engaged Community: High levels of activity and participation in discussions about platform developments and strategies. Collaborative Efforts: Onboarding of new DeFi teams to enhance the protocol's ecosystem.

Conclusion

Liquity presents a compelling investment opportunity with its innovative approach to decentralized borrowing, interestfree loans, and robust collateral management. The recent launch of Liquity v2 and the deployment of $BOLD on mainnet highlight the project's commitment to continuous improvement and stability. Strong community engagement and institutional interest further bolster its prospects. Traders should consider Liquity's unique value proposition and market position when making investment decisions.

This is not a financial advice. Please do your own research and consider the risks of trading cryptocurrencies.