News of Euler (EUL) - August 2024 Price Update - 10.78% Breakout Crypto News and Analysis

On August 13, 2024, at precisely 19:38 UTC, Euler (EUL) experienced a significant price breakout, surging by 10.78% to reach $5.37. This remarkable movement in the market is a testament to the strategic and technological advancements made by the Euler team. Known for its innovative approach to decentralized finance (DeFi), Euler's recent developments have captured the attention of investors and the broader crypto community. On August 13, 2024, the cryptocurrency Euler (EUL) experienced a significant breakout, with its price surging by 10.78% to reach $5.37. This breakout can be attributed to several key factors that have bolstered market confidence and driven investor interest. Let's delve into these reasons and understand the narrative behind Euler's recent success.

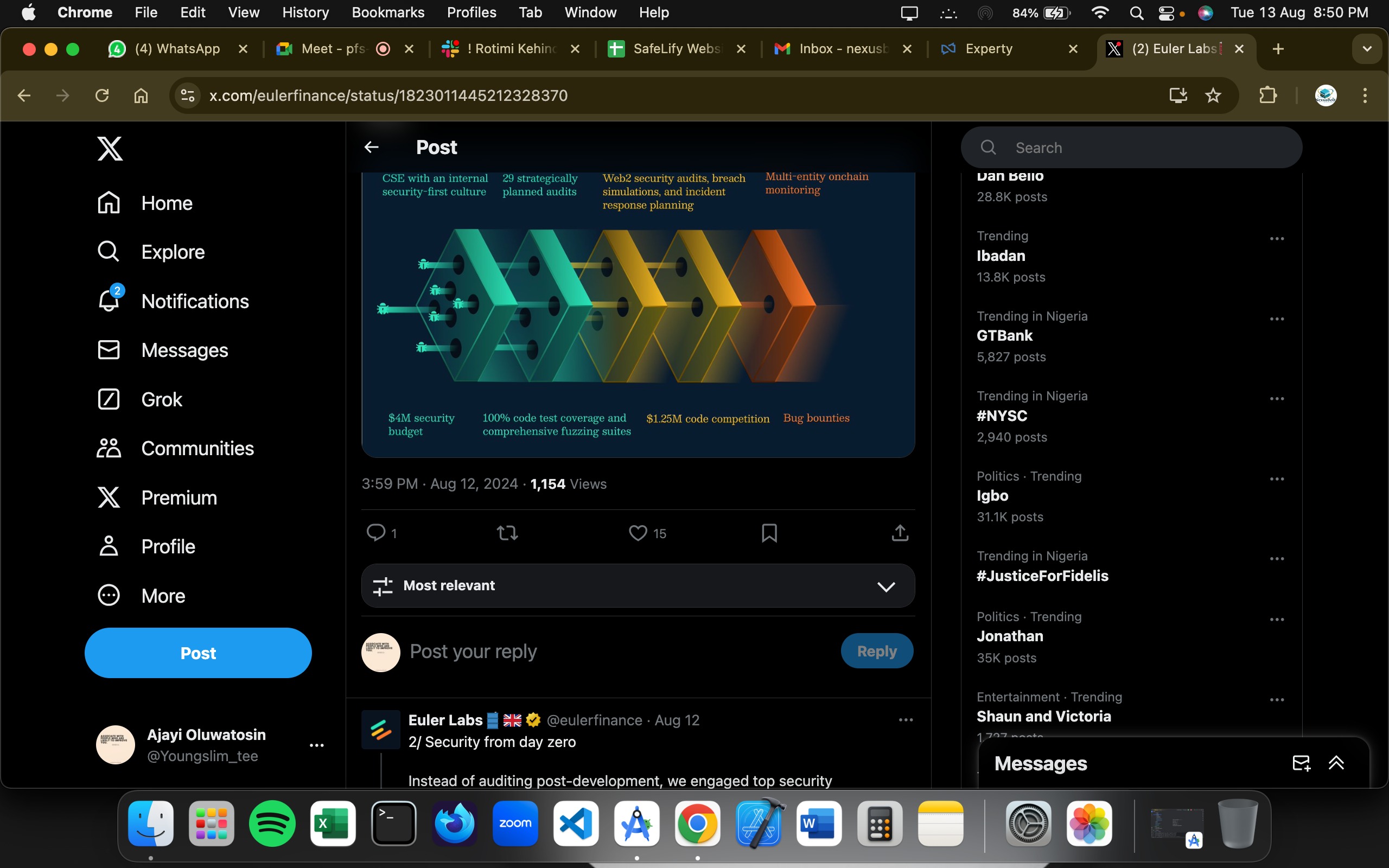

One of the primary reasons for Euler's breakout is the substantial allocation of funds by EulerDAO for the development of Euler v2. The DAO allocated more than $11 million, with over $4 million dedicated to enhancing security, including achieving ISO27001 compliance. This significant investment underscores the commitment to creating a secure and robust platform, which has positively influenced market sentiment.

EulerDAO allocates $11M for v2 development:

Another critical factor is Euler's innovative approach to security through its modular design and the implementation of the Swiss Cheese security model. By isolating core functions into independently operable modules, Euler has enhanced its security posture, making it more resilient to potential threats. This design not only improves security but also allows for greater flexibility and scalability.

Security through modularity and Swiss Cheese model:

Moreover, Euler's global code audit competition, which offered $1.25 million in rewards, attracted over 600 participants. The competition's outcome, with no high or mediumseverity issues found, further validated the security and reliability of Euler v2. This initiative has significantly boosted investor confidence in the platform's robustness.

Euler's $1.25M global code audit competition:

Additionally, the hiring of Erik as the Head of Security at Euler Labs has been a strategic move to strengthen the platform's security framework. Erik's collaboration with leading security engineers has ensured that Euler v2 is fortified against potential vulnerabilities, providing an added layer of assurance to users and investors alike.

Hiring Erik as Head of Security:

Lastly, Euler's response to a $200 million exploit in March 2023 has been commendable. The team prioritized safety in the development of v2 by conducting extensive audits, adopting a modular design, and collaborating with security experts. This proactive approach has not only mitigated risks but also restored trust in the platform.

Enhanced security measures after $200M exploit:

In conclusion, Euler's recent breakout can be attributed to its strategic investments in security, innovative design, and proactive measures to address past vulnerabilities. These efforts have collectively enhanced the platform's credibility and attracted significant investor interest, driving the recent surge in EUL's price. In conclusion, Euler's recent price breakout is a direct result of its commitment to security, innovation, and community engagement. The allocation of substantial funds for v2 development, the adoption of a modular design, and the organization of a global code audit competition underscore the project's dedication to creating a secure and flexible DeFi platform. As always, conducting thorough research (DYOR) is essential for navigating the complexities of the cryptocurrency market effectively.

We have asked 18 Experty community members questions related to "News of Euler (EUL) - August 2024 Price Update - 10.78% Breakout Crypto News and Analysis". We have received many valuable replies, the best ones (based on Experty community feedback) you can read below.

Interested in a specific topic?

Pick one keyword and dive into this theme

- platform

- euler

- audit

- market

- user

- chain

- protocol

- development

- euler finance

- launch

- medium

- severity

- euler labs

- post-audit

Cute, funny and a little bit crazy!!!

Explore the Core.

Euler is a modular lending platform allowing users to deploy and chain together their own customised lending markets in a permissionless manner.

Spot the Main Event:

Euler Prepares for v2 Launch with Unprecedented $4M Security Upgrade. Lending protocol Euler has secured $4 million to enhance the security of its upcoming v2 protocol, incorporating extensive audits, modular design, and expert collaboration to set new safety standards in the DeFi industry. Major Security Upgrade for Euler v2 Euler, a decentralized finance (DeFi) protocol, has allocated $4 million for a comprehensive security overhaul of its upcoming v2 platform. This move, backed by the Euler DAO, involves extensive code audits and the introduction of a modular architecture to reduce risks. The v2 platform, set for release in the second quarter of 2024, will adopt a modular structure and will feature components like the Euler Price Oracle, Euler Vault Kit (EVK), and the Ethereum Vault Connector (EVC), which are designed to offer users greater flexibility in creating lending markets. The push for enhanced security comes in the wake of a $200 million exploit that Euler suffered in March 2023. The incident has driven the protocol's developers to prioritize safety in the new version. The $4 million budget for security represents a significant increase compared to typical DeFi projects, which often allocate much lower amounts to security measures. Euler v2’s security framework's modular structure is conducive to isolating risks and simplifying the auditing process to ensure any vulnerabilities are identified and addressed promptly. Euler's security initiative has involved collaboration with several high-profile security experts, including engineers from Certora and the developer of the Yield protocol, Alberto Cuesta Cañada, and Cmichel, StErMi, leading security engineers from Spearbit. These experts have been involved in the project's early stages to help detect potential vulnerabilities. The development team also employed advanced testing methodologies such as fuzz testing and formal verification to complement the extensive audits. The protocol enabled extensive internal and external audits, with 29 code audits conducted by 12 top security firms. In addition to these efforts, Euler Labs organized a global code audit competition with $1.25 million in rewards for identifying bugs in the v2 codebase. The competition attracted over 600 participants, and no high or medium-severity issues were discovered. This further underscores the protocol’s emphasis on creating a secure platform for its users.

📸 Show Us What You Found:

Donmello

Explore the Core.

Euler v2 is a modular lending platform with two main components at launch: 1) the Euler Vault Kit (EVK), which empowers builders to deploy and chain together their own customised lending vaults in a permissionless manner; and 2) the Ethereum Vault Connector (EVC), a powerful, immutable, primitive which give vaults superpowers by allowing their use as collateral for other vaults. Together, the EVK and EVC provide the flexibility to build or recreate any type of pre-existing or future-state lending product inside the Euler ecosystem.

Spot the Main Event:

With the upcoming launch of Euler v2, the team has dedicated countless hours to making Euler as secure as possible. With v2’s development, security was at the forefront of how Euler would be designed. No shortcuts. No cost-cutting. 29 audits. Over a year of audits and testing. Hosted one of the largest code contests ever. Euler v2’s modular design, hiring Erik as Euler Labs’ Head of Security, and working together with some of the industry’s leading security engineers are just some of the steps that the team has undertaken to secure Euler…

📸 Show Us What You Found:

Trade hard. Joy is coming

Explore the Core.

Euler is a modular lending platform allowing users to deploy and chain together their own customised lending markets in a permissionless manner.

Spot the Main Event:

Crypto lending platform Euler Finance has announced the results of 29 audit reports from 12 different cybersecurity firms regarding its “v2” relaunch. According to the announcement, the reports show that all security issues were resolved. The protocol also held a public $1.25 million post-audit bug bounty that resulted in no medium or higher severity issues being found.In total, more than $4 million was spent to shore up Euler’s security in anticipation of the relaunch, the announcement stated.

📸 Show Us What You Found:

Explore the Core.

Euler is a modular lending platform allowing users to deploy and chain together their own customised lending markets in a permissionless manner.

Spot the Main Event:

Euler announces 29 audit reports after $4M spent to shore up security. Crypto lending platform Euler Finance has announced the results of 29 audit reports from 12 different cybersecurity firms regarding its “v2” relaunch. According to the announcement, the reports show that all security issues were resolved. The protocol also held a public $1.25 million post-audit bug bounty that resulted in no medium or higher severity issues being found.

📸 Show Us What You Found:

To God be the Glory

Explore the Core.

Euler is a modular lending platform allowing users to deploy and chain together their own customised lending markets in a permissionless manner.

Spot the Main Event:

Crypto lending platform Euler Finance has announced the results of 29 audit reports from 12 different cybersecurity firms regarding its “v2” relaunch. According to the announcement, the reports show that all security issues were resolved. The protocol also held a public $1.25 million post-audit bug bounty that resulted in no medium or higher severity issues being found. the new version of Euler “has undergone one of the most expensive and comprehensive security processes for any DeFi protocol to-date.” Euler’s decentralized autonomous organization, EulerDAO, allocated more than $11 million to the development team in order to develop v2, more than $4 million of which went to security. With these security funds, the team hired new staff tasked with making the protocol adhere to the ISO27001 standards used by banks and defense companies.

📸 Show Us What You Found:

Explore the Core.

Euler Finance is a non-custodial, permissionless lending protocol on Ethereum, enabling users to earn interest on their crypto assets or hedge against market volatility. It introduces DeFi features like permissionless lending markets, reactive interest rates, and MEV-resistant liquidations.

Spot the Main Event:

Announcement of the upcoming launch of Euler v2, that the team has dedicated countless hours to making Euler as secure as possible. With v2’s development, security was at the forefront of how Euler would be designed. No shortcuts. No cost-cutting. 29 audits. Over a year of audits and testing. Hosted one of the largest code contests ever. Euler v2’s modular design, hiring Erik as Euler Labs’ Head of Security, and working together with some of the industry’s leading security engineers are just some of the steps that the team has undertaken to secure Euler This is part of many several announcement made today others include Code competition, a $1.25M audit competition that involved 602 global researchers. Candidates challenged the codebase with their unique experiences and techniques.

📸 Show Us What You Found:

Overview

Euler is a decentralized, modular lending platform built on the Ethereum blockchain. Its mission is to revolutionize DeFi lending by providing a highly customizable and permissionless environment for deploying lending markets. Euler stands out in the crowded cryptocurrency market with its unique modular architecture, which allows for endless customization and scalability, making it adaptable to the evolving DeFi landscape.

Key Features

Modular Lending Platform: Users can deploy and chain together customized lending vaults using the Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC). Advanced Risk Management: Features include subaccounts, profit and loss simulators, and custombuilt limit order types. Synthetic Assets: Enables the creation of synthetic assets in a permissionless manner. Capital Efficiency: Allows lending of multiple assets and borrowing against a single collateral. Flash Loans: Supports flash loans, enabling borrowing without collateral if repaid in the same transaction. Governance Token: Empowers users to participate in protocol decisions and share in the platform's success.

Recent Developments

Security Upgrades: $4M spent on security upgrades, including 29 audit reports, to ensure the robustness of Euler v2. Community Engagement: Active community events, including AMAs and educational articles on security. Strategic Partnerships: Backed by top Web3 projects like HAUN, Paradigm, Coinbase Ventures, Variant, and Uniswap Lab Ventures. Product Updates: Introduction of new features and improvements, including a multilayer security system.

Market Impact

Increased TVL: Steady growth in Total Value Locked (TVL) indicates rising user trust and adoption. User Adoption: Enhanced user interface and expanded asset support are likely to attract more users. Strategic Partnerships: Collaborations with other DeFi projects could expand Euler's reach and influence in the market.

Risks and Opportunities

Challenges: Potential security breaches or technical issues could pose risks. Opportunities: The innovative approach to DeFi, including permissionless synthetic asset creation and advanced risk management tools, offers significant growth potential for traders and investors.

Community Engagement

Active Community: Strong presence on platforms like Discord and Telegram, with regular AMAs and community events. Educational Initiatives: Articles and resources to educate users about the platform's security and features. Support Base: Backed by prominent Web3 projects, indicating strong industry support.

Conclusion

Euler's innovative modular architecture and focus on security make it a compelling choice for traders looking for advanced DeFi solutions. The platform's recent developments and strategic partnerships position it well for future growth. Traders should consider Euler's potential for high user adoption and its robust risk management features when making investment decisions.

This is not a financial advice. Please do your own research and consider the risks of trading cryptocurrencies.