Coinbase Wrapped Staked ETH - May 2024 Price Update - 7% Breakout News and Analysis

On May 21, 2024, at precisely 00:33 UTC, Coinbase Wrapped Staked ETH (cbETH) experienced a significant breakout, with its price surging by 7%, reaching $3811.53. This remarkable price movement has caught the attention of the crypto community, prompting a closer look at the underlying factors driving this surge. Let's delve into the key reasons behind this breakout, supported by visual evidence for a comprehensive understanding.

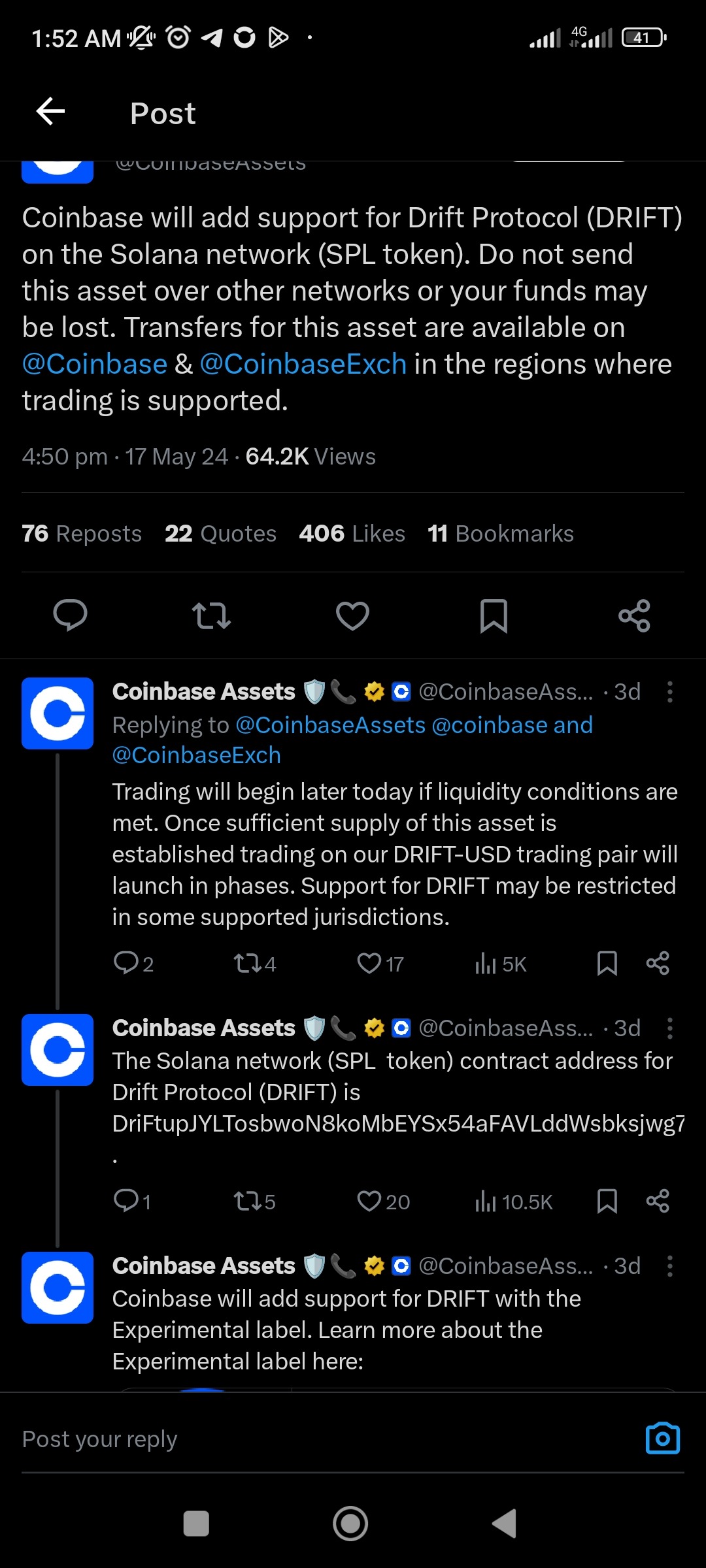

Drift Protocol launch on Coinbase: Drift Protocol (DRIFT) is now live on Coinbase, allowing users to buy, sell, and store these assets on multiple platforms.

Coinbase support for Drift Protocol on Solana: Coinbase announced support for Drift Protocol on the Solana network, boosting visibility and adoption.

ETH token rise benefits cbETH: cbETH is benefiting from the current rise of the ETH token, reflecting positively on its market performance.

Overview

Coinbase Wrapped Staked ETH (cbETH) is a utility token representing Ethereum 2 (ETH2) staked through Coinbase. The mission of cbETH is to provide liquidity to staked ETH, allowing users to trade, move, and use their staked assets in DeFi and other dapps without the typical lockup periods associated with staking. This project stands out by offering a liquid staking solution backed by the credibility and security of Coinbase.

Key Features

Liquid Staking Token: cbETH allows holders to benefit from staking rewards without lockups or unbonding periods. Tradable Asset: cbETH can be traded, moved onchain, and used in various DeFi applications. Convenience: Users can wrap their staked ETH to receive cbETH, maintaining liquidity while earning staking rewards. Centralized Issuance: Issued and controlled by Coinbase, providing a layer of trust and security.

Use Cases: DeFi Integration: cbETH can be used in decentralized finance applications, providing liquidity and earning potential. Trading: Users can trade cbETH on secondary markets, offering flexibility and liquidity.

Recent Developments

Drift Protocol (DRIFT) Integration: Drift Protocol is now live on Coinbase.com and the Coinbase iOS & Android apps with the Experimental label. Support for Solana Network: Coinbase has added support for Drift Protocol (DRIFT) on the Solana network (SPL token).

Market Impact

Increased Adoption: The integration of cbETH with DeFi services and its availability on major platforms like Coinbase can drive user adoption. Liquidity and Trading Volume: The ability to trade staked ETH without lockups can increase the trading volume of cbETH, reflecting growing demand. Staking Participation: By offering a liquid alternative, cbETH can incentivize more users to participate in staking, contributing to the security of the Eth2 network.

Risks and Opportunities

Risks: Centralization: cbETH is issued and controlled by Coinbase, which may introduce centralization risks. Potential Fees: Coinbase might charge fees associated with buying, selling, or holding cbETH.

Opportunities: User Education: Coinbase's efforts to educate users about staking options can increase awareness and adoption of cbETH. DeFi Integration: Potential integration with more DeFi services can expand the utility of cbETH. Market Growth: The overall growth of staked ETH on Eth2 can make cbETH a more attractive option for users seeking staking rewards.

Community Engagement

Twitter Activity: Active community engagement on Twitter, with regular updates and interactions. No Telegram or Discord: The project lacks official Telegram and Discord channels, which may limit community interaction.

Conclusion

Coinbase Wrapped Staked ETH (cbETH) offers a compelling solution for users seeking liquidity while earning staking rewards. Its integration with major platforms and DeFi services, backed by Coinbase's credibility, positions it well for future growth. However, traders should consider the centralization risks and potential fees associated with cbETH. Overall, cbETH's innovative approach and market position make it a noteworthy option for investment, especially for those looking to balance liquidity with staking rewards.

Summary

In summary, the breakout of Coinbase Wrapped Staked ETH (cbETH) in May 2024 can be attributed to strategic and technological developments, including the launch of Drift Protocol on Coinbase, support for Drift Protocol on the Solana network, and the positive market performance of the ETH token. These factors collectively enhanced the market position and usability of cbETH, driving its price surge. This event underscores the importance of conducting thorough research (DYOR) to navigate the complexities of the cryptocurrency market effectively.

Please Do Your Own Research always! We are not financial advisors, any information provided in this article is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we present is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.