News of Bitcoin Cash (BCH) - July 2024 Price Update - 7.24% Breakout Crypto News and Analysis

On July 29, 2024, Bitcoin Cash (BCH) experienced a significant breakout, surging by 7.24% to reach a price of $447.38. This unexpected rise occurred at 06:22 AM UTC and has caught the attention of the cryptocurrency community. Bitcoin Cash, a peertopeer electronic cash system, was created as a hard fork of Bitcoin in 2017 to address scalability issues. The recent price movement underscores the ongoing relevance and potential of BCH in the crypto market. On July 29, 2024, Bitcoin Cash (BCH) experienced a significant breakout, with its price surging by 7.24% to reach $447.38. This upward movement can be attributed to several key factors that have positively impacted BCH's market dynamics and adoption. Let's delve into the reasons behind this breakout and explore the detailed analysis of each contributing factor, supported by visual evidence for better understanding and engagement.

Government push to buy Bitcoin: Statements from prominent figures like Trump and RFK at the Bitcoin conference in Nashville have highlighted a push for the US government to acquire Bitcoin. This has created a ripple effect, boosting the overall sentiment around cryptocurrencies, including Bitcoin Cash.

Zapit integration with Coinsbee: The integration of Zapit with Coinsbee has expanded the utility of Bitcoin Cash by allowing users to purchase gift cards from global ecommerce sites using BCH. This increased usability has significantly enhanced BCH's market reach.

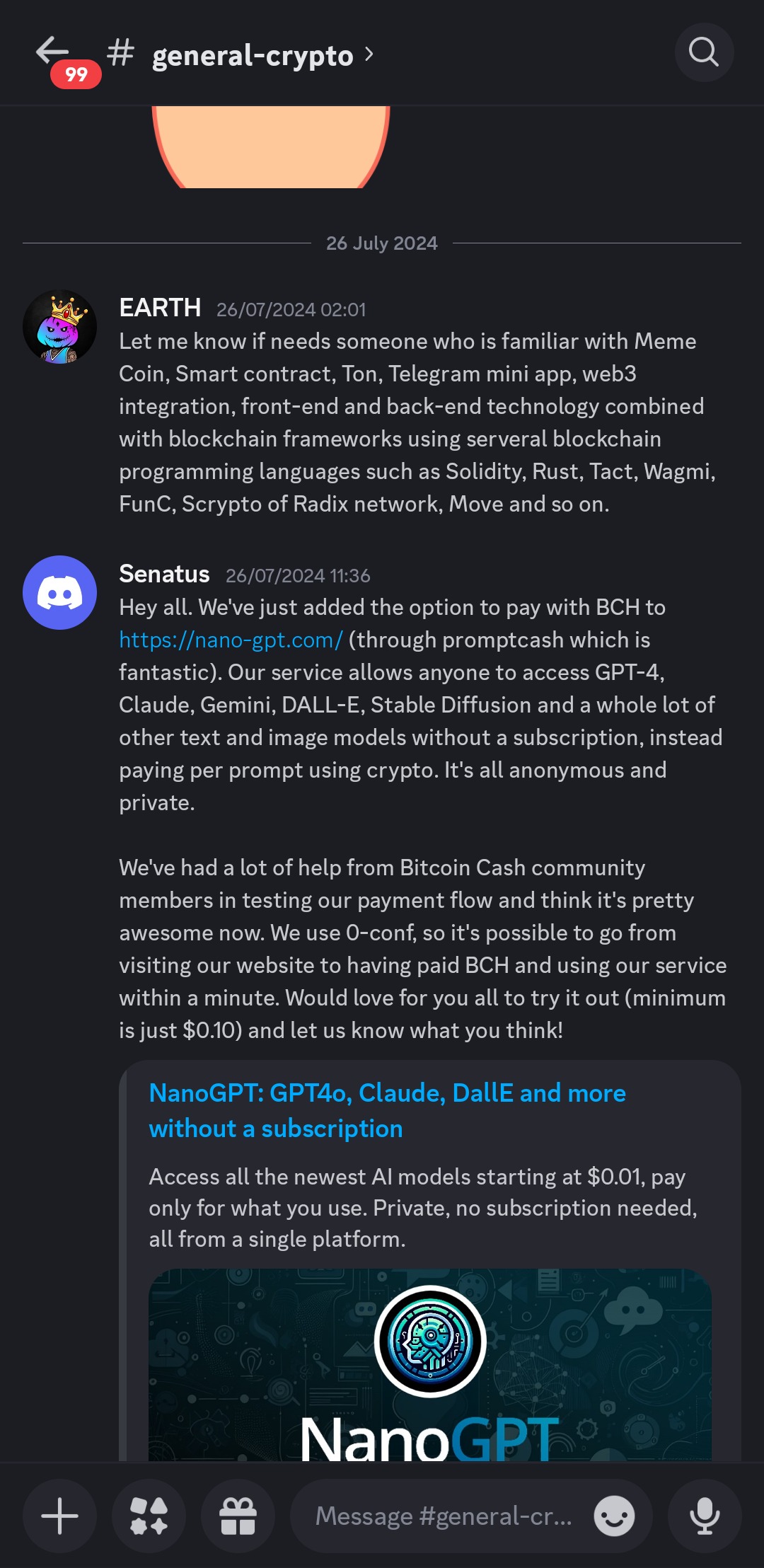

BCH integration with nanogpt.com: Nanogpt.com now accepts BCH for accessing AI models, thanks to the promptcash integration. This development has further boosted BCH adoption by providing a new use case for the cryptocurrency.

BCHF awareness efforts: The Bitcoin Cash Foundation (BCHF) has been actively spreading awareness about BCH and ensuring accurate information and branding across platforms. These efforts have helped in building a positive perception of BCH in the market.

Bitcoin spinoff affordability: Bitcoin Cash and other spinoffs attract retail traders due to their lower prices compared to Bitcoin. This affordability has driven investment from retail traders looking for cheaper alternatives to Bitcoin.

Recent BCH update: A recent update to Bitcoin Cash, featuring advanced features like RPC improvements, has driven the token's price increase. This update has enhanced BCH's technical capabilities, making it more appealing to investors and users.

These factors combined have created a favorable environment for Bitcoin Cash, leading to its notable price surge. As BCH continues to evolve and integrate with various platforms, its adoption and market value are likely to see further growth. In conclusion, Bitcoin Cash's recent breakout can be attributed to a combination of strategic integrations, governmental interest, and ongoing technological advancements. These factors highlight the dynamic nature of the cryptocurrency market and the importance of staying informed. As always, thorough research (DYOR) is essential for navigating the complexities of the crypto space effectively.

We have asked 26 Experty community members questions related to "News of Bitcoin Cash (BCH) - July 2024 Price Update - 7.24% Breakout Crypto News and Analysis". We have received many valuable replies, the best ones (based on Experty community feedback) you can read below.

Interested in a specific topic?

Pick one keyword and dive into this theme

Student

Explore the Core.

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size. As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties. Bitcoin Cash was created as an alternative to the first and most valuable cryptocurrency — Bitcoin (BTC). In 2017, BCH developers modified the BTC code, releasing their software version and a full-fledged competitive product, which split Bitcoin into two blockchains: Bitcoin and Bitcoin Cash. Bitcoin Cash is a result of a hard fork in the blockchain due to differences in the community over Bitcoin scaling and the SegWit upgrade. Moreover, another hard fork, which divided Bitcoin Cash into two parts, Bitcoin ABC and Bitcoin SV, took place in the fall of 2018. The scaling debate involved two sides: small block supporters opposed increasing block size as it could lead to blockchain centralization and vulnerability by making it harder to host full nodes. Large block supporters, however, advocated for a faster solution, concerned that rising transaction fees could hinder growth.

Spot the Main Event:

With the statements from Trump and RFK at the Bitcoin conference in Nashville, it's clear there's a push to get the US government into the business of buying Bitcoin. Originally, Bitcoin was at least in part created to save people from infinite inflation and devaluation. Now it will be complicit!

📸 Show Us What You Found:

web developer

Explore the Core.

Bitcoin Cash: A Fork for Scalability Bitcoin Cash emerged as a fork of the original Bitcoin blockchain in 2017 with the primary goal of addressing Bitcoin's scalability challenges. Solving Big Problems Scalability: Bitcoin Cash increased the block size to accommodate more transactions, aiming to improve transaction speed and reduce fees. Transaction Fees: By allowing for larger blocks, Bitcoin Cash aimed to lower transaction fees compared to the original Bitcoin. Innovative Use Cases While Bitcoin Cash primarily focuses on improving the core functionality of Bitcoin, its increased block size opens up possibilities for certain use cases: Point-of-Sale Transactions: Lower transaction fees make Bitcoin Cash more suitable for everyday purchases. Micropayments: Small-value transactions become more feasible due to reduced fees. Remittances: Faster transaction speeds and lower costs can benefit cross-border remittances.

Spot the Main Event:

Zapit users can now buy gift cards from a large selection of e-commerce websites around the world with #BitcoinCash🚀 This will enable Zapit users to spend their #BCH around the world through our integration with @coinsbee

📸 Show Us What You Found:

Student

Explore the Core.

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size. As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties. Bitcoin Cash was created as an alternative to the first and most valuable cryptocurrency — Bitcoin (BTC). In 2017, BCH developers modified the BTC code, releasing their software version and a full-fledged competitive product, which split Bitcoin into two blockchains: Bitcoin and Bitcoin Cash. Bitcoin Cash is a result of a hard fork in the blockchain due to differences in the community over Bitcoin scaling and the SegWit upgrade. Moreover, another hard fork, which divided Bitcoin Cash into two parts, Bitcoin ABC and Bitcoin SV, took place in the fall of 2018. The scaling debate involved two sides: small block supporters opposed increasing block size as it could lead to blockchain centralization and vulnerability by making it harder to host full nodes. Large block supporters, however, advocated for a faster solution, concerned that rising transaction fees could hinder growth.

Spot the Main Event:

News and speculations! With the statements from Trump and RFK at the Bitcoin conference in Nashville, it's clear there's a push to get the US government into the business of buying Bitcoin. Originally, Bitcoin was at least in part created to save people from infinite inflation and devaluation. Now it will be complicit! All because of the block size limit. Because of its restricted capacity, very few entities around the world will be able to actually, directly, use Bitcoin. Everyone else will have to use some custodial derivative, which cannot maintain the same provable scarcity. So the government will keep printing dollars. They will use those to buy Bitcoin, enriching themselves and the elites while draining value from regular people. It's no different if the government prints money to buy Bitcoin or fund some growth program: both steal from the people and benefit cronies who hold stocks in certain companies, or institutions who hold massive amounts of Bitcoin. Bitcoin will become a corporate bailout mechanism! As long as there's some lip service to the "bItCoIn-BaCkEd DoLlAr" and maxis' bags keep getting pumped, no one will complain. "The government was always going to do this eventually, you can't and shouldn't stop anyone from owning Bitcoin!" Yes! 100% true. But there's one massive difference with the way things turned out vs. the way they otherwise would have without constricted blocks: Digital cash vs. institutional asset! The lower down the socioeconomic totem pole people are, the higher the percentage of their net worth has to be liquid capital! If you're poor, you got only the money in your checking account. You may not even have a savings account, much less investments. And not just for the poor, for the middle class as well. Without digital cash use cases for Bitcoin, that liquid capital WILL be in US dollars! So when the government will print money to buy Bitcoin, they will still money from the little guy who can't afford to have illiquid Bitcoin, and will give to the corporate fat cats like Saylor and politicians who can afford to have massive stacks. Now, if Bitcoin had scaled to be money for the world, money printing wouldn't affect the little guy. They'd have their coffee budget in Bitcoin, wouldn't have to have USD at all, and only government bagholders would be affected. The dollar wouldn't be sustainable, and government would have to tax in Bitcoin and spend in Bitcoin without any ability to print it. But now, they have successfully co-opted the most radically freedom-giving technology of recent times.

📸 Show Us What You Found:

Football coach and sports analyst

Spot the Main Event:

Slippage, or price changes during execution of a trade, in the BCH market surged last week, signaling weak liquidity. BCH fell 20% last week, its biggest loss in three months, as Mt. Gox announced creditor repayments. Slippage surged across centralized exchanges, signaling poor liquidity as prices fell.9 Jul 2024. But there's been a gradual recovery

Explore the Core.

Bitcoin Cash is a cryptocurrency that is a fork of Bitcoin. Bitcoin Cash is a spin-off or altcoin that was created in 2017. In November 2018, Bitcoin Cash split further into two cryptocurrencies: Bitcoin Cash and Bitcoin SV. As with Bitcoin, the maximum supply of Bitcoin Cash has a hard cap of 21 million coins. The circulating supply as of May 2023 is 19,387,119 BCH

GLORIA OLUWAFERANMITo God be the Glory

Spot the Main Event:

The seeds of the BCHF were planted more than a year ago but work did not begin in earnest until June 2023.The purpose of the BCHF is to spread awareness of the Bitcoin Cash project and to ensure that relevant basic information and branding is correct across platforms. The BCHF also tasks themselves with filling all the tiny gaps in the BCH ecosystem that “someone” needs to do but as of yet does not have an owner. We are the sanitary engineers of P2P Electronic Cash.

📸 Show Us What You Found:

Explore the Core.

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size. As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties.

Ola VictoriaExplore the Core.

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size. As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties.

Spot the Main Event:

Bitcoin is becoming the money printer. With the statements from Trump and RFK at the Bitcoin conference in Nashville, it's clear there's a push to get the US government into the business of buying Bitcoin. Originally, Bitcoin was at least in part created to save people from infinite inflation and devaluation. Now it will be complicit

📸 Show Us What You Found:

A dedicated learner!

Explore the Core.

It looks like there's a lot of excitement building around Bitcoin Cash, especially with the upcoming Bitcoin Cash Conference in Buenos Aires in October 2024! 🎉 The conference, scheduled to take place from October 12 to 14, is expected to be a major event for Bitcoin Cash enthusiasts, bringing together experts, developers, and community members to discuss the latest developments and future plans for BCH.

Spot the Main Event:

Exciting announcement!! According to the team, they have just added an option to pay with BCH through promptcash which is fantastic! According to them also, their service will allow anyone to access the claude, Gemini, Dall, stable diffusion and a whole lot of other exciting text and image models without subscription.

📸 Show Us What You Found:

Explore the Core.

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size. As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties.

Spot the Main Event:

The surge in value of these Bitcoin spinoffs highlights investors’ growing interest, particularly among retail traders, in more affordable alternatives. Bitcoin is one of the most expensive assets to purchase, with one unit priced at nearly $70,000 as of this writing. The high price makes owning one full Bitcoin a bit difficult though investors can always get exposure by making fractional purchases. However, hard forks of the cryptocurrency, such as Bitcoin Cash, are priced much less in comparison, making them attractive buys, as they are viewed as cheaper plays by some investors.

📸 Show Us What You Found:

Trade hard. Joy is coming

Explore the Core.

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size. As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties.

Spot the Main Event:

The team have just added the option to pay with BCH to https://nano-gpt.com/ (through promptcash which is fantastic). Our service allows anyone to access GPT-4, Claude, Gemini, DALL-E, Stable Diffusion and a whole lot of other text and image models without a subscription, instead paying per prompt using crypto. It's all anonymous and private. We've had a lot of help from Bitcoin Cash community members in testing our payment flow and think it's pretty awesome now. We use 0-conf, so it's possible to go from visiting our website to having paid BCH and using our service within a minute. Would love for you all to try it out (minimum is just $0.10) and let us know what you think!

📸 Show Us What You Found:

Overview

Bitcoin Cash (BCH) is a peertopeer electronic cash system designed to become sound global money with fast payments, micro fees, privacy, and a larger block size. Created in 2017 as a hard fork from Bitcoin (BTC), Bitcoin Cash aims to address Bitcoin's scalability issues by increasing block size, thus enabling more transactions per block. This project stands out in the crowded cryptocurrency market due to its focus on scalability and low transaction fees, making it suitable for everyday transactions and micropayments.

Key Features

Technological Innovations

Increased Block Size: Bitcoin Cash increased the block size from Bitcoin's 1MB to 8MB initially, and later to 32MB, allowing for more transactions per block. Lower Transaction Fees: The larger block size helps in reducing transaction fees, making BCH more practical for smallvalue transactions. Fast Payments: Enhanced scalability ensures quicker transaction confirmations.

Use Cases

PointofSale Transactions: Suitable for everyday purchases due to low fees and fast transaction times. Micropayments: Feasible for smallvalue transactions, such as tipping or microdonations. Remittances: Lower costs and faster speeds make BCH ideal for crossborder money transfers.

Recent Developments

Bitcoin ABC 0.29.9 Release: Introduced RPC updates and several underthehood improvements. Community Growth: Continued expansion of the Bitcoin Cash community and increased merchant adoption. Upcoming Bitcoin Cash Conference: Scheduled for October 2024 in Buenos Aires, expected to bring together experts and community members to discuss future plans. Market Activity: Significant surge in open interest, with over $400 million indicating higher inflows and improved sentiment.

Market Impact

Increased Adoption: The focus on scalability and low transaction fees positions BCH as a practical alternative for everyday transactions, potentially increasing user adoption. Merchant Acceptance: Growing acceptance among merchants can drive demand and enhance BCH's market presence. Positive Sentiment: Recent developments and community engagement contribute to a positive market sentiment, potentially driving future growth.

Risks and Opportunities

Risks

Security Concerns: As with any cryptocurrency, BCH faces potential security risks, including vulnerabilities from larger block sizes. Market Competition: Competing cryptocurrencies focusing on scalability and low fees could impact BCH's market share. Regulatory Challenges: Changes in cryptocurrency regulations could affect BCH's adoption and market performance.

Opportunities

Scalability Enhancements: Ongoing discussions about potential upgrades could further improve transaction speeds and reduce fees. Increased Merchant Adoption: Continued efforts to onboard more merchants can drive demand and usage. Community Support: Strong community engagement and support can sustain growth and innovation.

Community Engagement

Active Community: The Bitcoin Cash community is active and growing, with significant participation in forums and social media. Engagement Strategies: Regular updates and events, such as the upcoming conference, help maintain community interest and involvement. Platform Presence: Active presence on major platforms like Twitter and Reddit, although some gaps in engagement on platforms like Discord.

Conclusion

Bitcoin Cash (BCH) presents a compelling investment opportunity due to its focus on scalability, low transaction fees, and fast payments. Recent developments and growing community support enhance its market position. However, traders should consider potential risks, including security concerns and market competition. Overall, BCH's innovative approach and practical use cases make it a strong candidate for investment, particularly for those interested in scalable digital cash systems.

This is not a financial advice. Please do your own research and consider the risks of trading cryptocurrencies.