Badger DAO - May 2024 Price Update - 7.51% Breakout News and Analysis

On May 29, 2024, at 09:24 AM UTC, Badger DAO (BADGER) experienced a significant breakout, with its price surging by 7.51%. This sudden movement saw BADGER's price rise to approximately $5.10, marking a notable shift in the market dynamics for this decentralized finance (DeFi) project. Several factors contributed to this impressive price surge, each playing a pivotal role in boosting investor confidence and market activity. Let's delve into these reasons with visual evidence to support our analysis.

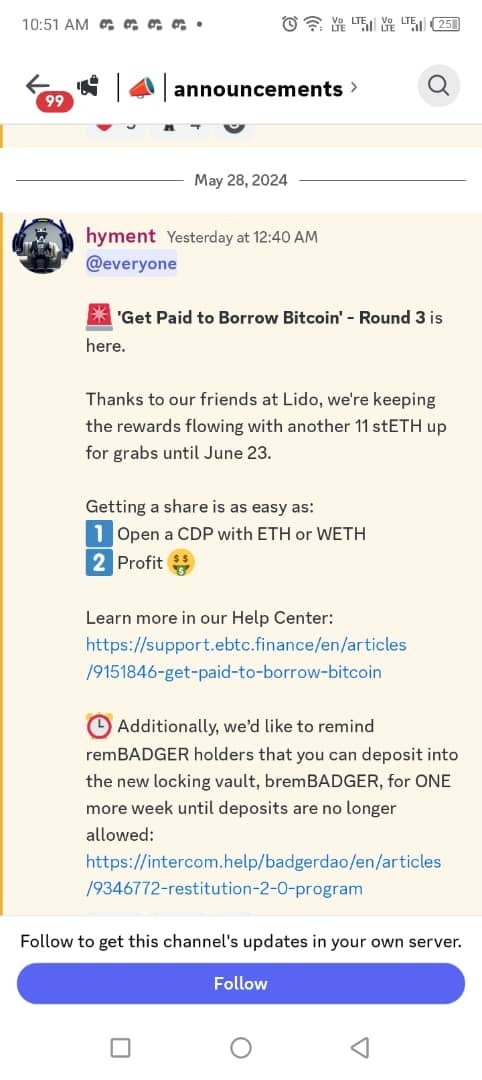

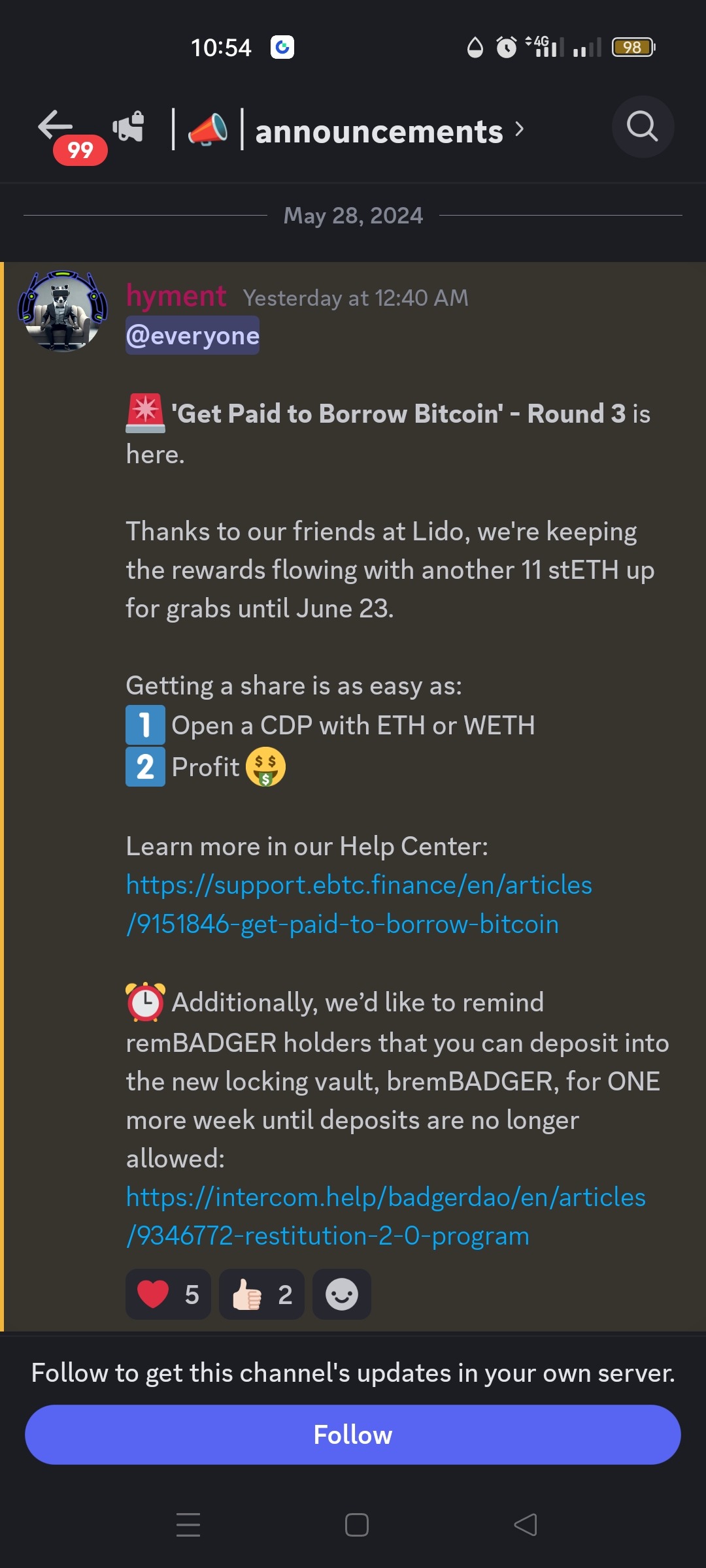

eBTC Lock Deposit Program: The recent announcement regarding the eBTC lock deposit program allowed members to borrow BTC by depositing into their lock. This initiative led to a substantial increase in deposits, driving the price upward.

Badger Restitution Program 2.0 and Bitcoin Borrowing Incentives: The introduction of the Badger Restitution Program 2.0 and the 'Get Paid to Borrow Bitcoin' Round 3 on Lido created a buzz within the community, further propelling the price surge.

Overview

Badger DAO is an opensource, decentralized autonomous organization (DAO) focused on integrating Bitcoin (BTC) into the decentralized finance (DeFi) ecosystem. Its mission is to simplify the use of Bitcoin as collateral across various smart contract platforms. The project stands out by providing a collaborative space for developers, known as Badge Builders, to implement Bitcoin as collateral on multiple blockchains, earning fees and BADGER tokens in the process.

Key Features

Developer Collaboration: Badge Builders can be individual developers, groups, or companies, with no fixed participation requirements. Incentive Structure: Developers earn a percentage of fees and BADGER tokens from the developer mining pool for each implementation. OpenSource Code: All code is opensourced, promoting transparency and communitydriven development. Governance: BADGER tokens are used for governance, allowing community members to vote on key decisions. Wrapped Bitcoin Solutions: Badger DAO creates wrapped versions of Bitcoin (e.g., WBTC) to enable its use in DeFi protocols on Ethereum and other blockchains.

Use Cases

Earning Interest: Users can deposit WBTC into DeFi lending protocols to earn interest. Providing Liquidity: Users can supply WBTC to liquidity pools on decentralized exchanges (DEXs) for potential rewards. Collateral for Borrowing: Users can borrow other cryptocurrencies using WBTC as collateral on DeFi lending platforms.

Recent Developments

Security Enhancements: Passed initial audit by Zokyo with no critical issues and established a security advisory committee. DIGG 2.0 Protocol: Launched in March 2023, introducing new features to improve the stability and usability of DIGG, the protocol's algorithmic stablecoin. Liquidity Proposals: New liquidity proposals approved on the Bitcoin layer 2 ecosystem. Community Incentives: Ongoing rewards for providing liquidity and borrowing Bitcoin, including partnerships with LidoFinance for additional incentives.

Market Impact

Increased Bitcoin Utility: By enabling Bitcoin to be used in DeFi, Badger DAO enhances Bitcoin's utility beyond just a store of value. Enhanced Liquidity: The project contributes to increased liquidity in DeFi markets, offering more borrowing options with Bitcoin as collateral. User Adoption: Recent developments and incentives are likely to drive user adoption and increase the total value locked (TVL) in Badger DAO's vaults.

Risks and Opportunities

Risks

Smart Contract Vulnerabilities: Potential security risks associated with smart contracts. Transaction Fees: High transaction fees on Ethereum could deter users. Competition: Other projects offering wrapped Bitcoin solutions could impact user adoption.

Opportunities

Growing DeFi Market: As DeFi continues to grow, Badger DAO's solutions could see increased demand. CommunityDriven Development: Opensource and community governance can lead to innovative solutions and rapid development. Partnerships: Collaborations with other DeFi protocols can expand Badger DAO's reach and utility.

Community Engagement

Community Size: Active community on Discord, with less activity on Telegram. Engagement Strategies: Regular updates and incentives to keep the community engaged, including liquidity rewards and governance participation. Social Media: Active presence on Twitter, sharing updates and engaging with the community.

Conclusion

Badger DAO presents a compelling opportunity for traders and investors by addressing the liquidity challenges of Bitcoin in the DeFi space. Its innovative approach, recent developments, and active community support position it well for future growth. However, traders should consider the risks associated with smart contract vulnerabilities and competition in the wrapped Bitcoin space. Overall, Badger DAO's focus on enhancing Bitcoin's utility in DeFi makes it a noteworthy project for investment consideration.

Summary

In summary, the recent price breakout of Badger DAO (BADGER) can be attributed to strategic developments such as the eBTC lock deposit program and the Badger Restitution Program 2.0. These initiatives not only enhanced the utility and appeal of BADGER but also fostered greater community engagement. As always, conducting thorough research (DYOR) is crucial for navigating the complex and dynamic cryptocurrency market effectively.

Please Do Your Own Research always! We are not financial advisors, any information provided in this article is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we present is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.